Most verification systems are designed for a single moment: onboarding.

When a customer buys an insurance policy, submits loan documents, or completes KYC, verification runs once. Identity is confirmed. Income is verified. Documents are validated. A decision is made - approve or reject. The system moves on.

But insurance and lending workflows don't end at onboarding. They evolve across months and years through a continuous lifecycle of changes, updates, and claims. A customer updates an address. Adds a nominee. Changes employment. Upgrades coverage. Files a claim. Renews a policy.

Each of these moments introduces new risk - and new data that must be verified against changing circumstances. Yet most verification stacks still treat them as isolated events, running the same rigid checks designed for initial onboarding even when the context has fundamentally changed.

This disconnect between static verification and dynamic lifecycles creates blind spots that compound over time, exposing insurers and lenders to fraud, compliance gaps, and operational inefficiency.

Where Static Verification Fails

The Onboarding Trap

Traditional verification systems optimize for a binary decision: Is this person who they claim to be? Do they meet eligibility criteria? Evidence is gathered, validated, and archived. The system considers its job complete.

This assumes information verified on Day 1 remains accurate indefinitely. In reality, customer circumstances change constantly: employment shifts, addresses update, life events occur, documents expire. Yet verification data remains frozen.

The Endorsement Blindspot

Endorsements - mid-policy changes - expose static verification's limitations. Adding a nominee should trigger verification: Is this person legitimate? What's their relationship to the policyholder?

Systems either over-verify (full onboarding documentation again, causing abandonment) or under-verify (processing on self-attestation, creating risk). The root problem: treating endorsements as either "onboarding events" or "trusted updates" when they need contextual verification - lighter than full onboarding, more rigorous than blind trust.

The Claims Validation Challenge

Claims stress-test verification against reality. A health insurance claim filed two years post-issuance requires validating current circumstances: employment status, address, treatment facility legitimacy, medical records. Onboarding data is outdated.

Traditional approaches rely on manual investigation: adjusters request updated documents, verify individually, reconstruct current profiles from scratch. Days or weeks pass. Fraud slips through because investigators lack complete context.

The Continuous Risk Problem

Real-world risk evolves continuously. Data accuracy degrades daily - addresses become outdated, employment changes, documents expire. Behavioral patterns shift. Fraud tactics adapt. Regulations update.

Systems treating verification as a one-time checkpoint miss these dynamics entirely.

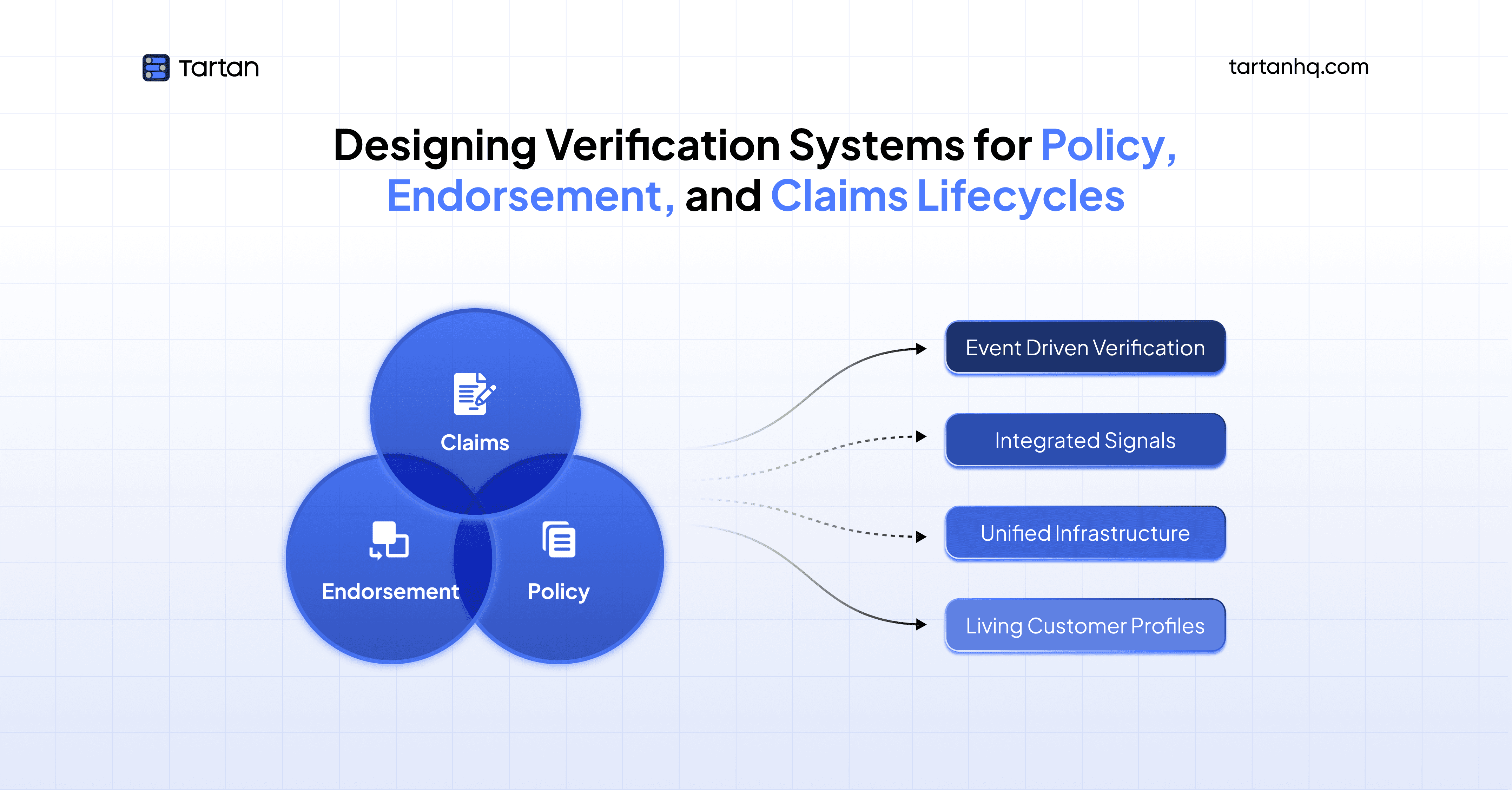

Designing for the Lifecycle: Three Critical Phases

Effective verification systems must adapt across the full customer journey:

1. Policy Issuance: Establishing the Baseline

At onboarding, verification creates a reliable identity and risk baseline:

Identity confirmation: Multi-factor verification combining government ID validation, biometric matching, and address verification establishes initial trust. But critically, this baseline is designed to evolve, not archived and forgotten.

Income and employment verification: Real-time data from HRIS systems or income databases validates financial capacity without manual document processing. This creates a verified employment record that can be referenced during endorsements and claims.

Risk assessment: Initial risk scoring based on identity signals, address risk levels, device intelligence, and behavioral patterns. This score becomes a benchmark against which future changes are measured.

Document validation: AI-powered document processing extracts and validates data from uploaded documents while detecting tampering or forgery. Document metadata and forensic markers are stored for future comparison.

The key distinction: onboarding establishes baseline truth that will be continuously validated and updated, not frozen as permanent fact.

2. Endorsements: Managing Change Without Friction

Endorsements require contextual verification - adapting checks to the type and magnitude of change:

Low-risk endorsements: Simple updates like contact information changes trigger lightweight re-verification. Address validation confirms the new address is legitimate using postal databases and geolocation services. Device intelligence checks that the request comes from a trusted device the customer has used before. No full identity re-verification needed, but the change is validated against fraud patterns.

Medium-risk endorsements: Changes to coverage amounts or beneficiaries trigger targeted verification. New beneficiaries undergo identity verification to ensure they exist and their relationship to the policyholder is genuine. Coverage increases may require updated income verification to ensure financial capacity matches new premium obligations. The system determines which specific checks are necessary based on the change type rather than running every verification module.

High-risk endorsements: Significant policy restructuring or ownership transfers trigger comprehensive re-verification approaching onboarding rigor - but with the advantage of comparing against the existing verified baseline to detect inconsistencies. If employment changed from verified Company A to Company B, that employment change itself becomes a verification data point rather than an anomaly.

This tiered approach eliminates the over-verification/under-verification trade-off. Verification intensity scales with actual risk introduced by the change, not arbitrary rules that either burden customers unnecessarily or create blind spots.

3. Claims: Validating Against Current Reality

Claims verification must reconcile historical policy data with current customer circumstances:

Identity reconfirmation: Is the claimant the actual policyholder? Biometric verification or device intelligence provides fast confirmation without requiring document resubmission. If the claim is filed from the same device used during policy issuance and endorsements, confidence is high. If it's a new device in a new location, additional validation triggers.

Current status validation: Employment, address, and income data are refreshed from real-time sources. Has the customer's job changed since policy issuance? Do they still live at the policy address? Are they still employed at the company listed on the policy? These updates happen automatically via API connections to authoritative data sources - HRIS systems, address validation services, employment databases.

Document verification: Medical bills, repair estimates, police reports, or other claim-supporting documents undergo the same AI-powered validation as onboarding documents - but with the additional context of the customer's verification history to detect inconsistencies. If a document's forensic markers differ significantly from documents previously submitted by this customer, it flags for review.

Cross-lifecycle pattern detection: Behavioral signals across the full customer relationship inform fraud detection. A customer who changed address three times in six months, filed claims immediately after coverage increases, and exhibited inconsistent employment patterns triggers investigation - patterns invisible when viewing claims in isolation but obvious across the lifecycle timeline.

The Architecture of Adaptive Verification

Persistent Customer Profiles

Rather than archiving verification after onboarding, adaptive systems maintain living profiles that evolve continuously. Each interaction adds data. The system tracks freshness and flags stale information for refresh. Risk scores update as new data arrives.

Event-Driven Verification

Integration with policy systems triggers verification when endorsements are requested or claims filed. Smart triggers determine appropriate verification intensity based on change magnitude and customer history. High-value policies receive scheduled refresh even without explicit changes.

Contextual Risk Orchestration

Current data is compared against verification history - inconsistencies trigger investigation. Identity, address, income, employment, behavioral, and device signals are evaluated together. Verification adapts to operational context: long-tenured customers receive expedited processing while new policyholders undergo rigorous validation.

Unified Operational Interface

Underwriters, claims adjusters, compliance officers, and fraud investigators work from shared verification infrastructure - eliminating silos and providing complete lifecycle context.

The Business Outcomes

Faster processing: Endorsements complete in hours instead of days through contextual verification. Claims settle faster with current verification data.

Reduced friction: Customers aren't asked to repeatedly submit documents. Simple updates process seamlessly.

Stronger fraud detection: Cross-lifecycle pattern recognition catches sophisticated schemes that onboarding-only verification misses.

Audit-ready compliance: Continuous verification ensures portfolio compliance with current regulations. Complete audit trails document ongoing validation.

Lower operational costs: Automation reduces manual work. Claims investigations and endorsement processing require fewer resources.

From Compliance Requirement to Competitive Advantage

Organizations designing verification around full lifecycles create strategic advantages:

Speed: Faster decisions across applications, endorsements, and claims because verification supports rather than blocks workflows.

Satisfaction: Verification adapts to context, reducing friction. Simple changes process instantly while complex changes receive appropriate scrutiny.

Scalability: Verification infrastructure scales through automation rather than linear headcount growth.

Resilience: Continuous verification creates resilience against evolving fraud, changing circumstances, and regulatory updates.

Optimization: Rich lifecycle data enables analytics on verification effectiveness, false positives, and cost-outcome correlations.

HyperVerify: Lifecycle-Native Architecture

HyperVerify is designed from the ground up for lifecycle-aware verification rather than retrofitting lifecycle capabilities onto onboarding-focused systems.

Persistent profiles: Customer verification data evolves continuously, not frozen after approval.

Event-driven orchestration: Lifecycle events - policy issuance, endorsements, claims, renewals - automatically trigger appropriate verification workflows.

Contextual intelligence: Verification intensity adapts based on change type, customer history, and risk signals rather than applying one-size-fits-all checks.

Unified platform: Identity, income, address, document, and fraud verification operate as integrated capabilities, not siloed vendors requiring manual correlation.

Workflow integration: Verification embeds into policy management, claims processing, and endorsement workflows rather than functioning as separate gates.

The result: verification becomes infrastructure that enables faster, smarter operations across the full customer lifecycle rather than a compliance checkbox at onboarding.

Conclusion

The insurance and lending industries are shifting from transactional relationships to continuous customer journeys. Policies span years or decades. Customers' circumstances evolve constantly. Risk profiles drift. Fraud tactics adapt.

Verification systems designed for a single onboarding moment can't serve these dynamics. They create blind spots where outdated data persists, endorsements slow down or bypass verification entirely, and claims rely on manual reconstruction of customer profiles.

Adaptive verification - designed around policy issuance, endorsement, and claims lifecycles - solves this by treating verification as ongoing risk management infrastructure rather than a one-time gate.

Organizations implementing lifecycle-aware verification don't just improve compliance. They move faster, scale cleaner, and build trust repeatedly across every customer interaction.

Verification stops being a necessary evil that slows operations. It becomes the foundation for confident, efficient customer lifecycle management.

HyperVerify enables this transformation - from static onboarding checks to adaptive assurance, embedded across every critical moment in the customer journey.

Tartan helps teams integrate, enrich, and validate critical customer data across workflows, not as a one-off step but as an infrastructure layer.