The workplace is becoming the new frontier for financial services distribution. Employees no longer need to visit bank branches or download lending apps - instead, they access credit, insurance, and investment products directly through their employer's benefits platform. This convergence of corporate benefits and financial services, known as embedded finance, is reshaping how salaried employees interact with credit products.

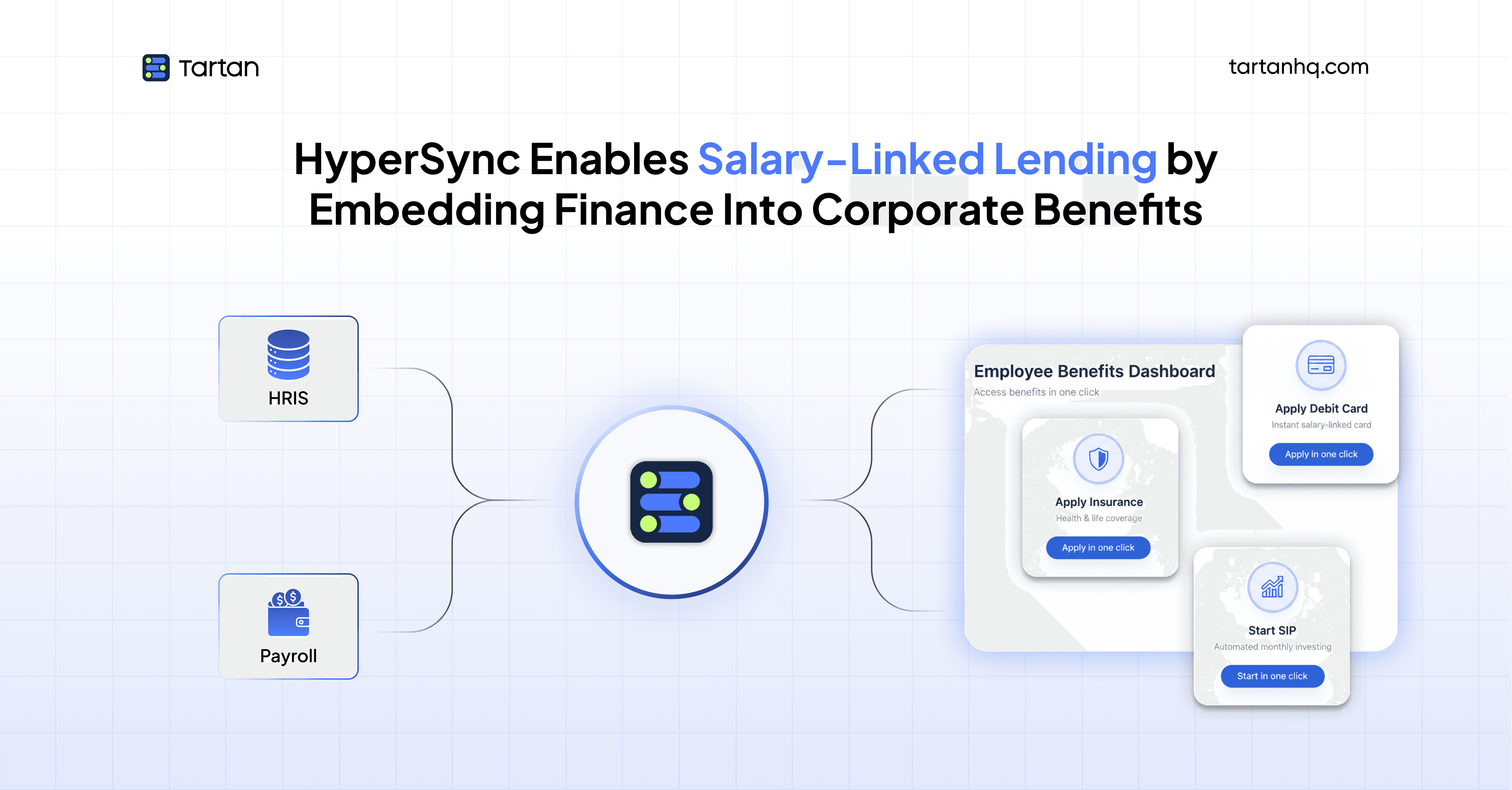

At the center of this transformation is a critical technical challenge: how do financial institutions and benefit platforms verify employment and income data in real-time to power instant lending decisions? The answer lies in unified API infrastructure that connects directly to corporate HRIS and payroll systems.

What is Embedded Finance in Corporate Benefits?

Embedded finance integrates financial services into non-financial platforms. In corporate benefits, this means employees access loans, salary advances, and credit products directly through their employer's benefits portal - without visiting banks or downloading lending apps.

Corporate India employs over 100 million salaried workers needing credit for emergencies, education, and major purchases. Traditionally, accessing this credit meant submitting salary slips and bank statements - a process taking days or weeks.

Embedded lending through employer platforms compresses this timeline dramatically: instant approval based on verified salary data, with loan EMIs automatically deducted from monthly payroll.

The Technical Foundation: Why HRIS Integration Matters

For embedded lending to work at scale, lenders need real-time access to verified employment and income data. This is where unified API infrastructure becomes essential.

Traditional lending relies on self-reported data: employees upload salary slips which lenders must manually verify. This creates friction (employees abandon applications during document submission), delay (verification takes days), and fraud risk (salary slips can be forged).

HRIS integration solves all three problems. When a lending platform connects directly to a corporate's HRIS system - whether that's Darwinbox, Keka, Workday, greytHR, or others - it can instantly verify:

Current gross salary and take-home pay

Employment tenure and designation

Employment status (active vs. on notice)

Historical salary stability over past months

Existing payroll deductions

This verified data enables instant credit decisions. A personal loan application that traditionally took five days can be approved in two minutes because the lender has certainty about the borrower's income and employment.

How HyperSync Enables Salary-Linked Lending

HyperSync is a unified API platform that connects benefit platforms and lenders to 100+ HRIS and payroll systems. Rather than building separate integrations for Darwinbox, Keka, Workday, and dozens of other platforms, lenders integrate once with HyperSync and immediately gain access to employee data across all supported systems.

Real-Time Income Verification

When an employee applies for a loan through an embedded lending platform, HyperSync fetches current salary data from the corporate's HRIS in real-time. The lender receives verified information - not self-reported data that requires manual checking - enabling instant underwriting decisions.

This is particularly powerful for contingency lending and salary advances. An employee needing emergency funds for a medical expense can receive approval and disbursal within hours because income verification is automated.

Payroll-Deducted EMI Collection

The most transformative aspect of salary-linked lending is automated EMI deduction directly from payroll. Here's how it works:

Employee applies for a loan and receives approval

Lending platform sends loan and EMI details to HyperSync

HyperSync creates a recurring deduction in the corporate's payroll system

Each month, the EMI is automatically deducted from the employee's salary before they receive take-home pay

Deducted amount is transferred directly from employer to lender

This payroll deduction model fundamentally changes lending economics. Traditional unsecured lending faces default rates of 2-4% because borrowers must manually transfer EMI each month. With payroll-deducted loans, default rates drop below 0.5% because the deduction happens at source - before the employee even receives their salary.

For lenders, this means better capital efficiency and ability to offer lower interest rates. For employees, it means one less payment to worry about each month.

Lifecycle-Triggered Lending

With real-time access to employment data through HyperSync, lending platforms can offer products at relevant moments in an employee's lifecycle:

New hire (Month 1): Small personal loan for relocation or furnishing expenses, offered at lower rates due to verified employment

Promotion (Salary increase detected): Immediate pre-approved loan offer at improved rates reflecting higher income

Employment stability (2+ years tenure): Home loan pre-qualification with complete salary history verified through HRIS

This lifecycle-based approach delivers significantly higher conversion rates than generic loan marketing because offers arrive when employees actually need credit.

Use Cases Transforming Employee Financial Wellness

Earned Wage Access (EWA)

Earned wage access allows employees to withdraw already-earned salary before payday. EWA platforms integrated with HyperSync calculate earned wages in real-time based on days worked and allow instant withdrawal of up to 50% of earned wages, with automatic payroll deduction next cycle. A manufacturing company implementing EWA saw measurable retention improvements as workers accessed emergency funds without expensive payday loans.

Personal Loans with Instant Approval

Embedded lending platforms enable instant personal loan approvals based on verified salary data, competitive rates due to reduced default risk from payroll deduction, and transparent EMI visibility before confirmation. An IT services company achieved 60% credit card adoption in three months - triple their previous bank partnership - through instant approval and automated bill payment.

Why Banks and NBFCs Are Adopting This Model

Financial institutions implementing embedded lending through HyperSync integration see measurable advantages:

Lower customer acquisition cost: Acquiring customers through employer channels costs 60-70% less than traditional retail channels

Higher approval rates: Verified income data enables approving customers who might be rejected in traditional processes due to documentation gaps

Superior default performance: Payroll-deducted loans show default rates below 0.5% compared to 2-4% for traditional unsecured lending

Faster time-to-market: Instead of 12-18 months to build custom HRIS integrations, banks go live in 8-12 weeks

The Scalability Challenge Solved

The primary barrier to embedded lending has been technical integration complexity. A bank wanting to offer salary-linked lending to corporate employees faces a fragmented HRIS landscape: clients use Darwinbox, Keka, Workday, SAP SuccessFactors, greytHR, and dozens of other platforms.

Building custom integrations for each HRIS is economically unviable. Each integration requires months of engineering effort, ongoing maintenance when platforms update APIs, and dedicated resources for troubleshooting.

HyperSync's unified API solves this by providing a single integration point that works across 100+ HRIS platforms. A lender integrates once and can immediately serve employees across any supported corporate client - regardless of their underlying HRIS system.

This abstraction enables financial institutions to scale embedded lending programs without integration work becoming a bottleneck.

The Future: Complete Financial Ecosystem

Salary-linked lending opens the door to comprehensive employee financial platforms: automated insurance premium deductions, salary-linked investments, financial wellness programs, and emergency assistance funds - all operating through verified employment data and seamless payroll integration.

Conclusion

Embedded finance in corporate benefits fundamentally shifts how salaried employees access financial services. Employees receive seamless credit access through employer platforms - with instant approvals powered by verified employment data and frictionless repayment through payroll deduction.

HyperSync's unified API makes this possible at scale by connecting lending platforms to 100+ HRIS systems through a single integration. The result: lending products that are faster, cheaper, and more reliable than traditional channels.

The workplace has become the most powerful distribution channel for financial services. The question for financial institutions isn't whether to embrace embedded lending, but how quickly they can deploy the infrastructure to compete in this new paradigm.

Tartan helps teams integrate, enrich, and validate critical customer data across workflows, not as a one-off step but as an infrastructure layer.