In 2026, employers face healthcare costs rising at unprecedented rates - projected increases between 6% to 10% annually, marking the steepest climb in over a decade.

Yet the real cost isn't just in premiums. It's in the hundreds of hours your HR teams spend manually enrolling employees in group health insurance, the errors that lead to coverage gaps, and the employee frustration that impacts retention.

For corporate decision-makers managing workforces across multiple locations, subsidiaries, or insurance carriers, the group health insurance enrollment challenge has reached a breaking point.

Manual processes that once worked for 100 employees crumble under the weight of 1,000. The traditional approach - spreadsheets, email chains, paper forms, and siloed systems - is failing both your organization and your people.

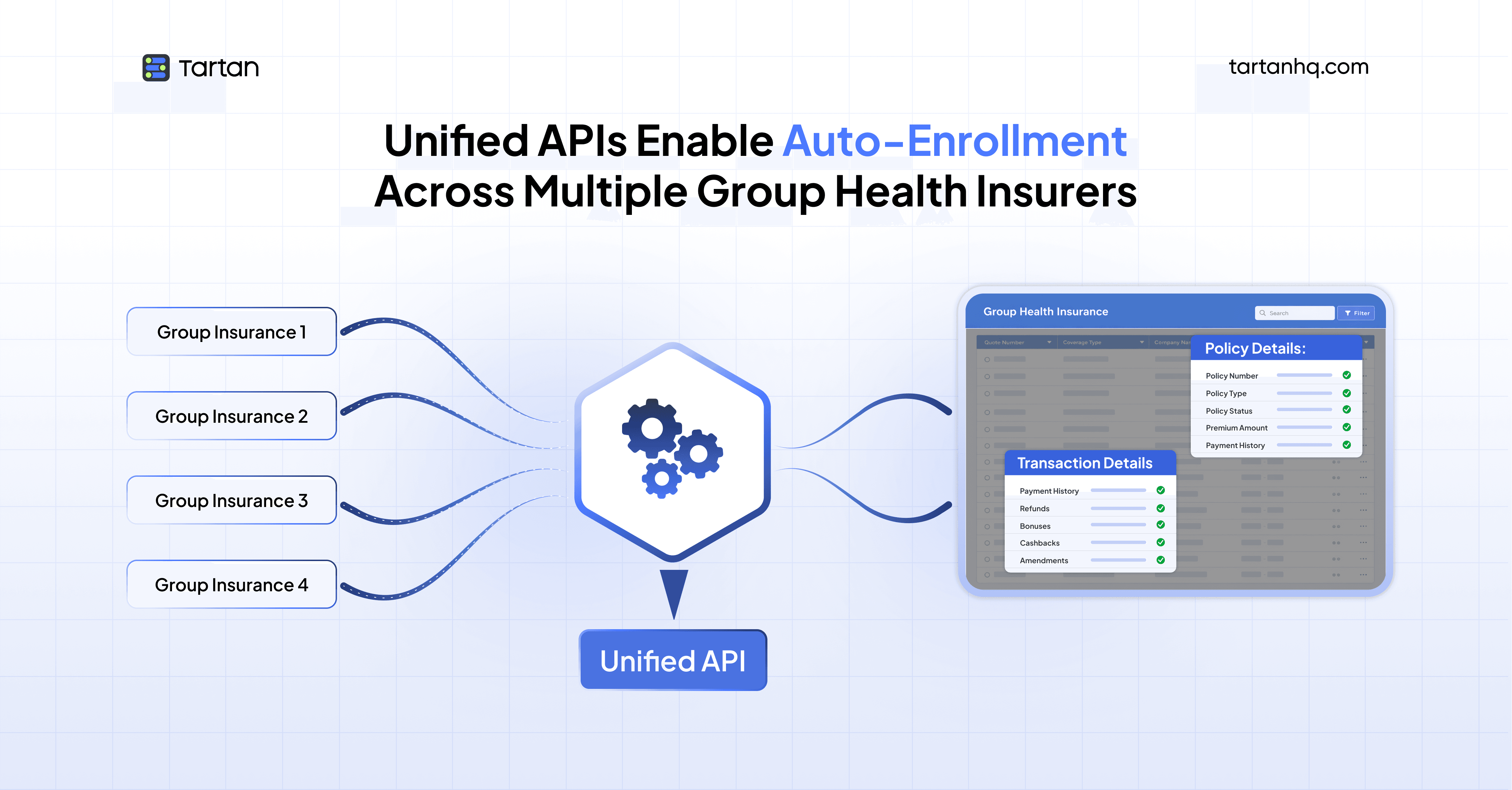

This is where unified APIs are transforming corporate benefits administration. This article explains what unified APIs are, why they matter for group health insurance enrollment, and how they can reduce your enrollment timeline from weeks to hours while eliminating costly errors.

Understanding the Group Health Insurance Enrollment Crisis

Before exploring the solution, it's essential to understand the magnitude of the problem facing today's enterprises.

The Traditional Enrollment Process: A Case Study in Inefficiency

Consider a mid-sized company with 2,000 employees preparing for their annual open enrollment period. Here's what the traditional process looks like:

Week 1-2: Data Collection

HR sends emails to department heads requesting updated employee information

Employees fill out paper forms or PDFs with personal details, dependent information, and coverage selections

Forms trickle back slowly; HR follows up repeatedly with stragglers

Missing information requires multiple rounds of back-and-forth communication

Week 3-4: Data Entry and Validation

HR staff manually enter employee selections into spreadsheets

Each entry takes 10-15 minutes; with 2,000 employees, that's 500+ hours of manual work

Error rates in manual data entry average 1-4%, meaning 40-80 employees have incorrect information

Staff attempt to cross-reference employee eligibility against multiple data sources

Week 5-6: Insurer Submission

HR exports data from spreadsheets into insurer-specific formats

Different insurers require different file formats and data structures

Files are uploaded via insurance company portals or sent via SFTP

Inevitably, some submissions are rejected due to formatting errors

The cycle of corrections and resubmissions begins

Week 7-8: Reconciliation and Issue Resolution

Insurance carriers process enrollments and return error reports

HR investigates discrepancies: Why was employee X rejected? Why is dependent Y showing as ineligible?

Employees who thought they were enrolled discover coverage gaps

Emergency processing for employees who need immediate coverage

This eight-week ordeal happens annually, and it assumes everything goes relatively smoothly. In reality, the process often extends to 10-12 weeks when dealing with multiple insurance carriers, complex organizational structures, or international employees.

The Hidden Costs

The real cost of this manual process extends far beyond the obvious:

Direct Labor Costs: If your HR team spends 500 hours on manual enrollment at an average loaded cost of $50/hour, that's $25,000 per enrollment cycle in labor alone - and this doesn't include the opportunity cost of what your HR team could be doing instead.

Error Remediation: Research indicates that each claim error costs between $30-71 to remediate. With error rates of 1-4% across 2,000 employees making an average of 3 claims per year, you're looking at $1,800-$17,040 in additional administrative costs annually.

Coverage Gaps: When enrollment errors result in coverage gaps, employees may delay needed medical care, leading to worse health outcomes and eventually higher claims when conditions become acute. Furthermore, employees who experience coverage issues are significantly more likely to be dissatisfied with their employer.

Compliance Risk: Manual processes increase the risk of regulatory non-compliance. Missing ACA reporting deadlines, failing to properly document special enrollment periods, or incorrectly calculating affordability can result in substantial penalties.

Employee Experience Impact: According to recent studies, over half of employees regret their benefits choices, often because the enrollment process was confusing or information was unclear. Poor enrollment experiences directly impact employee satisfaction and retention.

The Multi-Insurer Complexity Multiplier

The challenge becomes exponentially more complex when organizations work with multiple insurance carriers - a common scenario for:

Large enterprises: Different carriers for different regions or subsidiaries

Multinational corporations: Local insurers in each country of operation

Companies offering choice: Multiple plan options across several insurance providers

Organizations pursuing risk diversification: Splitting coverage across carriers to manage risk

Each additional insurer means:

Another unique data format to master

Another set of enrollment rules and validation requirements

Another portal or submission method to manage

Another reconciliation process to complete

Another point of potential failure

When organizations manage 3-5 different insurance carriers, the manual effort doesn't just triple or quintuple - it increases exponentially due to the overhead of context-switching and error propagation across systems.

What Are Unified APIs? A Primer for Non-Technical Leaders

If you're a CXO evaluating solutions for your benefits administration challenges, you don't need to be a software engineer to understand unified APIs. Think of them as a universal translator for software systems.

The Core Concept

In traditional system integration, if you want your HR system to communicate with five different insurance carriers, you need to build five separate connections:

Learn how Carrier A's system works → Build connection A

Learn how Carrier B's system works → Build connection B

Learn how Carrier C's system works → Build connection C

And so on...

A unified API changes this paradigm. Instead of building five separate connections, you build one connection to the unified API provider. That provider has already built and maintains connections to all the insurance carriers you need.

How Unified APIs Work: The Three-Layer Model

Layer 1: Your Systems (HRIS/Payroll) Your organization maintains employee data in systems like Workday, ADP, BambooHR, or SAP SuccessFactors. This data includes employee demographics, employment status, compensation, and organizational structure.

Layer 2: The Unified API (The Translation Layer) The unified API provider - such as Finch for payroll/HRIS integration or specialized benefits platforms - sits in the middle. This layer performs three critical functions:

Data Normalization: Takes employee data from your HRIS and transforms it into a standardized format

Protocol Translation: Converts that standardized data into each insurance carrier's specific required format

Bidirectional Synchronization: Ensures data flows both ways - from your HRIS to insurers and from insurers back to your systems

Layer 3: Insurance Carrier Systems Multiple insurance carriers, each with their own systems, data requirements, and submission protocols. The unified API handles all the complexity of connecting to each one.

A Real-World Analogy

Imagine you run a global corporation and need to communicate with partners in 20 countries.

Traditional Approach: You hire 20 translators - one for each language. Each translator only knows one language. If one translator leaves, you're stuck until you find a replacement. If a new country partnership emerges, you need to find and train another translator.

Unified API Approach: You hire one translation service that employs specialists in all 20 languages. You speak English to the service; they handle all translations. When a new language is needed, the service adds that capability without requiring anything from you. If translation protocols change in any language, the service handles updates transparently.

The unified API is that translation service for your benefits administration systems.

Key Benefits for Decision-Makers

Integration Velocity Instead of 12-18 months to build direct integrations with multiple carriers, you can go live in 6-8 weeks with a unified API approach.

Maintenance Burden Reduction When an insurance carrier updates their API (and they do, frequently), the unified API provider handles the update. You don't lift a finger. Without unified APIs, each carrier update requires your IT team to test and deploy changes.

Scalability Without Complexity Need to add a new insurance carrier? With traditional integration, that's a 3-6 month project. With unified APIs, if the provider already supports that carrier, activation can happen in days.

Cost Predictability Unified API providers typically charge based on connected employees or API calls - predictable, scalable pricing. Traditional integration requires significant upfront development investment plus ongoing maintenance costs that scale with the number of integrations.

The Unified API Solution for Group Health Insurance Enrollment

Now let's examine how unified APIs specifically transform group health insurance enrollment processes.

The New Enrollment Workflow

Here's how the same 2,000-employee enrollment scenario plays out with unified API integration:

Day 1: Automated Data Synchronization

Employee data automatically syncs from your HRIS to the unified API platform

The platform pulls demographics, employment status, dependent information, and salary data

Data validation happens automatically using built-in business rules

Potential issues are flagged immediately for review

Day 2-3: Employee Self-Service Enrollment

Employees access a unified enrollment portal (often embedded in your existing benefits platform)

The system pre-populates all known information, reducing employee effort

Employees make plan selections through a guided interface

Real-time eligibility checks prevent invalid selections

Dependent verification happens automatically through integrated databases

Day 4-5: Automated Multi-Carrier Submission

The unified API transforms enrollment data into each carrier's required format

Submissions happen automatically to all carriers simultaneously

Built-in validation catches formatting errors before submission

Confirmation receipts are logged and stored

Day 6-7: Automated Reconciliation

Carrier acceptance confirmations flow back through the unified API

Exceptions are flagged automatically with specific error details

Corrections can be made and resubmitted instantly

Your HRIS is updated with final enrollment status

Total Timeline: 7 days instead of 8+ weeks - an 80%+ reduction in processing time.

Technical Capabilities That Enable This Transformation

Real-Time Data Synchronization

Unified APIs for HR and payroll systems (like those provided by Finch, KOMBO, or Merge) create a continuous data pipeline between your HRIS and benefits administration systems. Key capabilities include:

Automatic Updates: When an employee's status changes in your HRIS - new hire, termination, salary change, address update - that change propagates automatically to insurance systems. No manual file uploads required.

Bidirectional Flow: Not only does employee data flow to insurers, but confirmation data, claim information, and eligibility updates flow back to your HRIS, creating a single source of truth.

Change Detection: Webhook notifications alert your benefits systems the moment relevant data changes, enabling immediate action for time-sensitive events like new hires who need day-one coverage.

Intelligent Data Normalization

Different insurance carriers use different terminology, data structures, and validation rules. Unified APIs handle this complexity automatically:

Field Mapping: What one carrier calls "dependent" another might call "covered_family_member." The unified API maps these fields correctly for each carrier.

Data Transformation: If Carrier A requires dates in MM/DD/YYYY format while Carrier B requires YYYY-MM-DD, the API handles conversion transparently.

Validation Rules: Each carrier has specific requirements - SSN format validation, address standardization, relationship codes for dependents. The unified API enforces these rules before submission, catching errors early.

Multi-Carrier Orchestration

Perhaps the most powerful capability for organizations using multiple insurers is the ability to manage them all through a single interface:

Parallel Processing: Enrollment data is submitted to all carriers simultaneously rather than sequentially, dramatically reducing total processing time.

Carrier-Specific Business Logic: Some carriers require pre-authorization for dependent enrollment; others don't. Some need employer contribution amounts; others don't. The unified API handles these carrier-specific requirements automatically.

Unified Error Handling: When an error occurs with one carrier, it doesn't halt processing for others. Errors are isolated, clearly reported, and can be corrected independently.

Transformative Use Cases for Corporate Benefits Leaders

Let's examine specific scenarios where unified APIs deliver exceptional value:

Use Case 1: New Employee Onboarding with Day-One Coverage

The Challenge: New employees need health insurance coverage from their first day, but traditional processes create gaps. HR receives offer acceptance, creates HRIS record, waits for the next enrollment batch processing window, manually submits to insurers, and waits for confirmation - a process that can take weeks.

The Unified API Solution:

Employee accepts offer and completes enrollment during pre-boarding

Upon start date, HRIS automatically creates employee record

Unified API detects new employee, triggers enrollment workflow

Enrollment is submitted to insurance carrier within hours

Confirmation received by end of first business day

Employee has active coverage from day one

Business Impact: Improved new hire experience, reduced administrative burden, elimination of coverage gap liability, competitive advantage in talent acquisition.

Use Case 2: Multi-Subsidiary Corporate Group Enrollment

The Challenge: A holding company owns five subsidiaries, each with different insurance carriers based on historical acquisitions. Annual enrollment requires coordinating across five HR teams, five different enrollment processes, and five carrier relationships.

The Unified API Solution:

Central benefits team configures unified API integration once

All five subsidiaries' HRIS systems connect to the same unified API

Each subsidiary maintains its carrier relationships, but enrollment is standardized

Central reporting provides consolidated view across entire organization

Economies of scale in benefits administration while preserving local carrier relationships

Business Impact: 60-70% reduction in total enrollment processing time, standardized employee experience across subsidiaries, centralized compliance monitoring, ability to negotiate better terms with carriers using consolidated data.

Use Case 3: Salary-Linked Premium Collection

The Challenge: Employees enrolled in insurance have premiums deducted from paychecks. Traditional process requires manually updating payroll systems with premium amounts for each employee, a process prone to errors and timing mismatches.

The Unified API Solution:

Employee enrolls in insurance through benefits portal

Unified API automatically creates deduction record in payroll system

Premium amounts are pulled directly from insurance carrier confirmation

If premiums change (annual increases, plan changes), deductions update automatically

Employees see accurate deductions in first paycheck

Business Impact: Elimination of manual payroll adjustments, zero timing errors between enrollment and payroll, reduced employee inquiries about incorrect deductions, automated premium reconciliation between payroll and carriers.

Use Case 4: Compliance Automation for ACA Reporting

The Challenge: ACA reporting requirements mandate that employers track and report on health insurance offers and coverage. Manual tracking across multiple carriers creates compliance risk.

The Unified API Solution:

All enrollment data flows through unified API, creating comprehensive audit trail

Automated generation of 1095-C forms based on enrollment and coverage data

Real-time compliance monitoring alerts to potential issues (e.g., employees approaching hours threshold for required coverage)

Consolidated reporting across all carriers for year-end compliance

Business Impact: Reduced compliance risk, elimination of penalty exposure, automated 1095-C generation, simplified audit preparation.

Implementation Considerations for Decision-Makers

As a CXO evaluating unified APIs for group health insurance enrollment, here are critical factors to consider:

Selecting the Right Unified API Provider

Coverage Assessment: Does the provider support all insurance carriers your organization uses? For global organizations, does coverage extend to regional carriers in your operating markets?

Data Model Depth: Benefits enrollment requires specific data fields - dependent relationships, coverage tiers, contribution amounts, enrollment dates. Ensure the provider's data model includes everything you need.

Write Capabilities: Some unified APIs are read-only, allowing you to pull data but not submit enrollments. For true automation, you need bidirectional write capabilities.

Security and Compliance: Benefits data is highly sensitive. Verify the provider maintains SOC 2 Type II certification, supports data encryption in transit and at rest, and complies with relevant data protection regulations (HIPAA in the US, GDPR in Europe).

Integration Speed: Ask for reference customers and typical implementation timelines. The promise of unified APIs is speed - verify providers can deliver.

Building the Business Case

When presenting unified API investment to your board or finance committee, structure your business case around:

Hard Cost Savings:

Reduction in HR labor hours for enrollment processing

Elimination of temporary staffing during enrollment periods

Reduction in error remediation costs

Potential reduction in benefits administration vendor costs

Soft Cost Savings:

HR team redeployment to strategic initiatives vs. administrative work

Reduction in employee service desk inquiries during enrollment

Faster time-to-market for new benefit offerings

Risk Reduction:

Compliance penalty avoidance

Reduction in coverage gap liability

Improved data security vs. spreadsheet-based processes

Strategic Enablement:

Ability to support M&A integration more rapidly

Foundation for future benefits innovations (e.g., personalized recommendations, predictive analytics)

Improved employee experience contributing to retention

Change Management Requirements

Unified API implementation isn't purely technical - it requires organizational change:

Stakeholder Alignment: Benefits teams, HR operations, IT, payroll, and insurance brokers all need to understand how workflows will change.

Process Redesign: Take advantage of automation to redesign processes, not just automate existing inefficiencies.

Training Investment: While unified APIs reduce complexity, teams still need training on new systems and workflows.

Vendor Partnership: Treat your unified API provider as a strategic partner. Regular business reviews, roadmap discussions, and feedback loops ensure the platform evolves with your needs.

Looking Forward: The Future of Benefits Administration

Unified APIs represent the foundation for next-generation benefits administration. Forward-looking organizations are leveraging this infrastructure for:

Predictive Analytics: Using historical enrollment data to predict future selections, identify employees likely to waive coverage, and optimize plan offerings.

Personalized Recommendations: AI-driven guidance helping employees choose optimal plans based on their personal health profiles, past utilization, and financial situation.

Embedded Benefits: Offering insurance products at the point of need - mortgage insurance during home loan approval, disability insurance during life events - all powered by real-time HRIS data via unified APIs.

Continuous Enrollment: Moving beyond annual open enrollment to year-round plan optimization as life circumstances change.

Global Benefits Harmonization: Unified API platforms with global coverage enabling true standardization of benefits experience across multinational workforces while respecting local carrier relationships and regulatory requirements.

Conclusion: From Administrative Burden to Strategic Advantage

For CXOs and corporate decision-makers, group health insurance enrollment has traditionally been viewed as a necessary administrative burden - something to get through annually with minimal disruption. Unified APIs fundamentally change this calculus.

By automating the mechanical work of data collection, validation, carrier submission, and reconciliation, unified APIs free your benefits team to focus on what truly matters: designing benefit programs that attract and retain talent, supporting employees through health challenges, and creating a culture where people feel valued and protected.

The transformation from eight-week manual processes to one-week automated workflows isn't just about efficiency - though the hundreds of hours saved per enrollment cycle are substantial. It's about fundamentally reimagining what's possible in benefits administration.

When enrollment happens automatically, you can offer employees the flexibility to adjust coverage as their lives change rather than forcing them to wait for annual open enrollment. When data flows seamlessly between systems, you can provide employees with accurate, real-time information about their coverage rather than discovering gaps weeks later. When compliance is automated, you can confidently expand benefit offerings knowing reporting requirements will be handled systematically.

Most importantly, when your HR and benefits teams aren't drowning in spreadsheets and manual data entry, they can focus on being strategic partners to your business - designing innovative benefit programs, analyzing utilization patterns to optimize costs, and creating enrollment experiences that employees actually appreciate.

In an environment where healthcare costs are rising at 6-10% annually, where employee expectations for seamless digital experiences are higher than ever, and where the competition for talent has never been more intense, unified APIs provide the technical foundation for benefits administration that is efficient, accurate, scalable, and employee-centric.

The question isn't whether your organization will adopt unified APIs for benefits enrollment - it's whether you'll lead the transformation or be forced to catch up when manual processes finally collapse under their own complexity. The organizations making this investment today are building sustainable competitive advantages in operational efficiency, employee experience, and strategic agility that will compound over years.

For forward-thinking CXOs, the time to act is now. The technology is mature, the business case is clear, and the competitive imperative is undeniable. Transform your group health insurance enrollment from a source of annual dread to a seamless, automated process that works for your employees, your HR team, and your bottom line.

Tartan helps teams integrate, enrich, and validate critical customer data across workflows, not as a one-off step but as an infrastructure layer.