The fintech that launches fastest wins the market.

When a lending startup identifies an underserved segment, the window to establish leadership is measured in weeks, not months. Competitors are building the same product. The team that goes live first captures early adopters and builds defensibility.

Yet most fintech teams spend 4-6 months on onboarding infrastructure before acquiring their first customer. Not building core products or refining underwriting models - instead, integrating identity verification providers, address validation services, document processing vendors, fraud detection platforms, and income verification APIs.

Each requiring separate contracts, integrations, and compliance reviews.

By the time they launch, competitors who solved verification faster are already iterating based on real customer feedback. The opportunity window has narrowed.

Why Verification Delays Go-to-Market

Modern lending requires comprehensive customer verification:

Identity verification: Validating government IDs, matching biometrics, checking identity databases.

Address verification: Confirming residence is legitimate, deliverable, and matches customer claims.

Income verification: Assessing repayment capacity through employment databases and bank statement analysis.

Document processing: Extracting and validating data from uploaded documents with OCR accuracy and fraud detection.

Fraud detection: Device intelligence, behavioral signals, and cross-application pattern analysis.

Each capability requires a specialized vendor. Each vendor requires integration work: evaluate providers, negotiate contracts, integrate APIs, test edge cases, handle failures. The timeline compounds: 3-4 weeks per integration, often sequential. Six months vanishes before the first customer applies.

The Build vs. Buy Trap

Some teams consider building verification in-house: "Identity verification is just ML models. Address validation is database lookups. We have engineering talent."

This underestimates complexity. Identity verification requires document authentication, liveness detection, cross-database validation, and supporting dozens of ID types - years of investment.

Address validation faces incomplete postal databases, inconsistent formats, and regional variations. Document processing works in demos but production includes poor lighting, partial occlusions, and adversarial users. Fraud detection requires continuously updated pattern databases and behavioral baselines.

Teams that build discover they've consumed engineering capacity building infrastructure with gaps compared to commercial solutions while creating technical debt. The build path extends time-to-market, not accelerates it.

The Point Solution Problem

Most teams buy best-of-breed point solutions for each verification need. This creates different problems:

Integration complexity: Five vendors means five API designs, authentication methods, and error patterns to learn.

Orchestration burden: Custom code managing when checks run, handling vendor downtime, coordinating workflows.

Cost unpredictability: Five pricing models requiring complex forecasting.

Data silos: Fraud signals from one vendor don't inform another. Identity confidence doesn't flow into underwriting.

Debugging friction: When verification fails, which vendor caused it? Investigating each separately.

The point solution approach may beat building from scratch, but integration still consumes 3-4 months - longer than markets allow.

What Fast-Moving Teams Actually Need

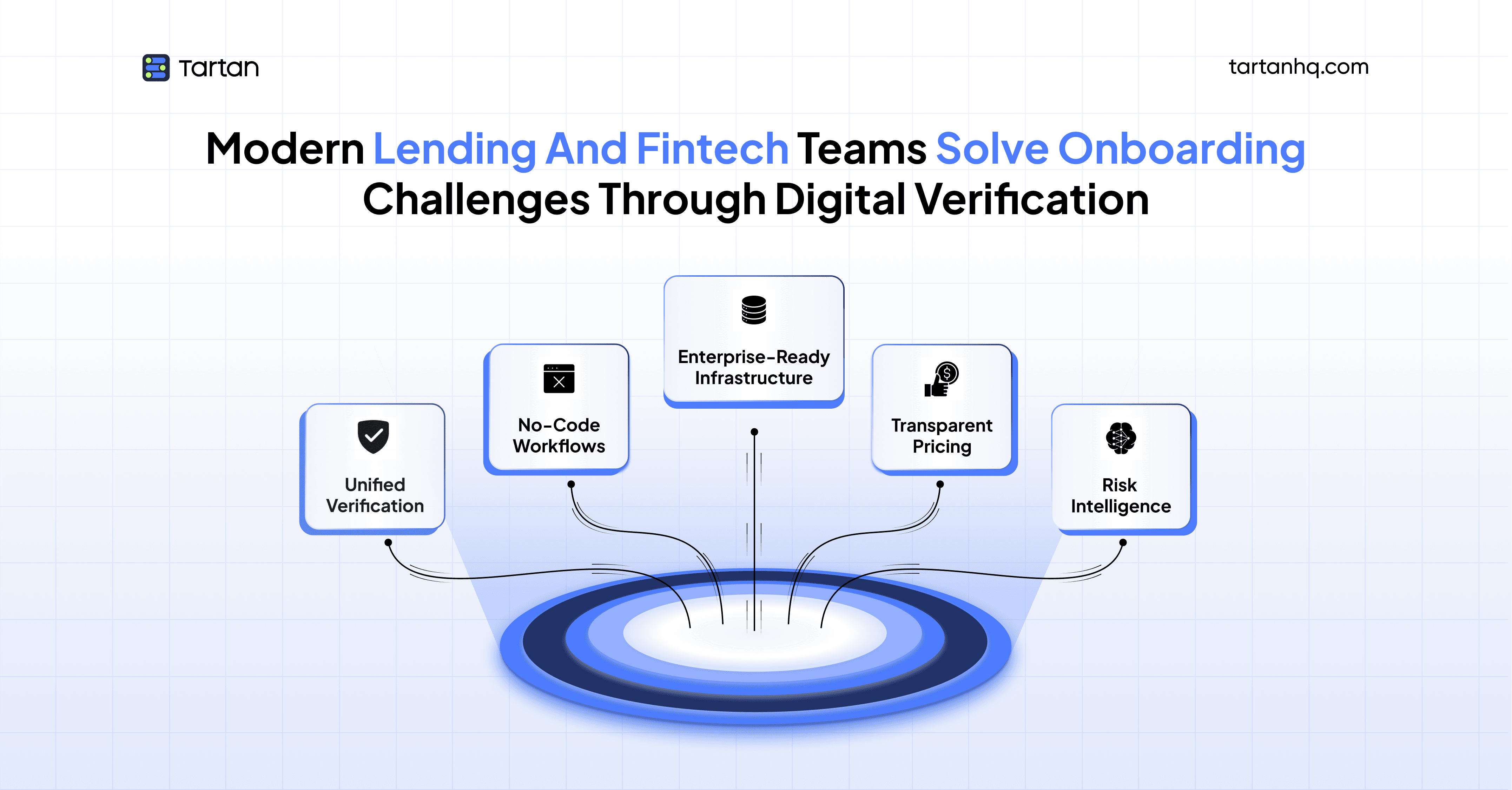

Successful fintech teams launching in weeks share common infrastructure: unified verification providing comprehensive coverage through single integration.

Requirements: Complete verification coverage (identity, address, income, documents, fraud - one platform). Single integration (one API, one authentication). Fast deployment (1-2 weeks to production). Flexible orchestration (workflows configured via dashboards). Unified data model (all signals in one response). Transparent costs. Production-ready reliability.

HyperVerify: Built for Fintech Speed

HyperVerify provides the unified verification infrastructure modern lending and fintech teams need to eliminate onboarding as a go-to-market bottleneck.

Comprehensive Verification in One Platform

HyperVerify covers the complete verification stack:

Identity verification: Government ID validation, biometric matching, liveness detection, and database checks. Supports PAN cards, Aadhaar, passports, driver's licenses, voter IDs across multiple countries. Real-time verification results with confidence scores.

Address validation: Postal database validation, geolocation verification, and address standardization. Confirms addresses are deliverable, legitimate, and match claimed locations. Handles Indian addresses with their format variations and international addresses for global expansion.

Document processing: AI-powered OCR extracting data from any document type - bank statements, salary slips, utility bills, rental agreements, business licenses. Automated fraud detection identifying tampered or forged documents. Data validation ensuring extracted information matches expected patterns.

Income verification: Real-time employment and salary verification through HRIS integrations, bank statement analysis for income assessment, and GST data for business income verification. Eliminates reliance on easily forged salary slips.

Fraud detection: Device intelligence identifying applications from known fraud devices, behavioral analytics detecting suspicious application patterns, velocity checks preventing multiple applications from the same entity, and cross-customer pattern analysis identifying coordinated fraud rings.

All accessible through HyperVerify's unified API. No additional integrations required.

Workflow Flexibility Without Code

Verification requirements evolve. Early-stage products start with basic identity and address checks. As the product matures, fraud patterns emerge requiring additional signals. Risk policies need adjustment based on portfolio performance.

HyperVerify enables this evolution without code deployments:

Configurable workflows: Define verification sequences through dashboard interfaces. Add or remove verification steps. Adjust decision thresholds. Implement A/B tests comparing different verification strategies.

Risk-based routing: High-risk applications (new device, suspicious behavioral signals) undergo more rigorous verification. Low-risk applications (returning customers, trusted devices) receive expedited processing. Routing logic configurable based on real-time risk signals.

Progressive verification: Basic checks at application initiation (identity, address) with additional verification (income, documents) required only when moving toward approval. This optimizes conversion by not overwhelming users with upfront requirements.

Geographic customization: Different verification requirements for different markets. International expansion doesn't require new integrations - just workflow configuration for new geographies.

Teams launch with one verification approach, iterate based on actual fraud and conversion data, and optimize without waiting for engineering sprints.

Unified Risk Intelligence

HyperVerify's platform architecture enables risk intelligence impossible with siloed point solutions:

Cross-signal correlation: Identity verification confidence informs fraud detection. Address data correlates with device location. Income verification results contextualize application amounts. All signals analyzed together for holistic risk assessment.

Pattern recognition across verifications: An applicant whose uploaded bank statement shows different employment than their claimed employer triggers investigation. Address changes during the application process flag for review. These patterns emerge only when all verification data shares a common platform.

Fraud network detection: When multiple applications share device fingerprints, IP addresses, or document patterns, HyperVerify identifies potential fraud rings. This cross-applicant analysis requires centralized verification data.

Continuous learning: Fraud patterns detected in recent applications inform verification rules for incoming applications. The platform learns and adapts based on actual fraud encountered across all customers.

This unified intelligence provides better fraud detection with lower false positive rates than disparate vendor signals requiring manual correlation.

Transparent, Predictable Economics

HyperVerify's pricing eliminates the unpredictability of multiple vendor bills:

Usage-based pricing: Pay for verification API calls actually made. No minimum commitments in early stages. Costs scale naturally with customer acquisition.

Volume discounts: Automatic pricing tiers based on usage. As verification volume grows, unit costs decrease without renegotiating contracts.

All-inclusive: Identity, address, documents, income, fraud detection - all included in base pricing. No surprise charges for "premium" verification types or additional feature access.

Monthly billing: One invoice covering all verification activity. Finance teams reconcile a single vendor bill instead of aggregating costs across five providers.

For early-stage teams managing runway carefully, this cost predictability matters. For scaling teams, simplified billing reduces financial operations overhead.

Production-Grade Infrastructure

HyperVerify is built for fintech production requirements:

High availability: 99.9% uptime SLA ensures verification doesn't become a bottleneck during peak application periods or marketing campaigns.

Low latency: Sub-second verification responses for real-time onboarding flows. Customers don't wait while APIs process requests.

Scalability: Infrastructure that handles traffic spikes without degradation. Launch day traffic surges or viral growth don't break verification.

Security and compliance: SOC 2 Type II certified. Data encryption in transit and at rest. GDPR and data protection regulation compliance built-in. Regular security audits and penetration testing.

Developer experience: Comprehensive API documentation, code libraries in major languages, sandbox environments for testing, webhook debugging tools, and responsive technical support.

Teams deploy with confidence that verification infrastructure won't limit growth.

The Go-to-Market Impact

Teams using HyperVerify report measurable acceleration:

Faster launches: 4-6 weeks to market instead of 4-6 months - leading categories versus following them.

Reduced engineering load: Core verification deployed in 2 weeks, freeing capacity for differentiated features.

Iteration velocity: Workflow changes in hours (dashboard configuration) versus weeks (code deployments).

Lower overhead: One vendor, one integration, one compliance review. Teams stay focused on core business.

Better risk outcomes: Unified intelligence catches fraud patterns siloed verification misses.

Predictable costs: Single pricing model. No surprise overages.

The compounding effect: faster launches mean learning from customers sooner, iterating while competitors build infrastructure, establishing market leadership.

Conclusion

Digital verification isn't a competitive differentiator. No customer chooses your lending product because your identity verification is superior. Yet building or integrating verification infrastructure traditionally consumes months of go-to-market timeline - months competitors use to establish market position.

Modern fintech teams solve this by standardizing on unified verification platforms that provide comprehensive coverage through single integrations. This shifts verification from a 4-6 month integration project to a 2-week deployment, fundamentally changing go-to-market economics.

HyperVerify provides this infrastructure: identity, address, income, document, and fraud verification in one platform, integrated in days instead of months, with workflow flexibility enabling continuous optimization without code changes.

For lending and fintech teams facing competitive markets where speed determines winners, the question isn't whether unified verification makes sense - the operational and timeline advantages are clear. The question is whether to build differentiated lending products or spend months integrating verification vendors.

Teams choosing HyperVerify choose to build products, not infrastructure. They go to market in weeks, iterate based on real customer data, and establish market leadership while competitors are still in integration sprints.

In fast-moving fintech markets, verification infrastructure that accelerates rather than delays launch isn't just operationally efficient - it's strategically essential.

Tartan helps teams integrate, enrich, and validate critical customer data across workflows, not as a one-off step but as an infrastructure layer.