In lending, the journey from the first disbursal to final closure is complex, involving multiple stages where borrower data needs to be continuously validated.

As financial institutions manage their loan portfolios, it's clear that verifying borrower information solely at the point of origination is no longer sufficient to protect against evolving risks. To mitigate fraud, ensure compliance, and maintain operational efficiency, it’s critical for financial institutions to implement lifecycle-based verification.

Leveraging lifecycle-based verification is not only a regulatory necessity but also a strategic advantage for lenders to mitigate risk, prevent fraud, and maintain operational efficiency.

Re-verification is not just a regulatory requirement, it’s a strategic measure that helps lenders manage risk, minimize fraud, and optimize operational processes.

Continuous re-verification is now essential as borrower data is not static; it evolves over time. Employment status, financial health, and even address details can change between the time of loan origination and its closure.

By integrating ongoing verification, lending institutions can avoid the costly consequences of relying on outdated or incomplete borrower data. It also ensures they remain compliant with stringent regulations, protecting them from potential fines or legal issues. Moreover, continuous data validation enhances the overall lending experience, building trust with borrowers and regulatory bodies alike.

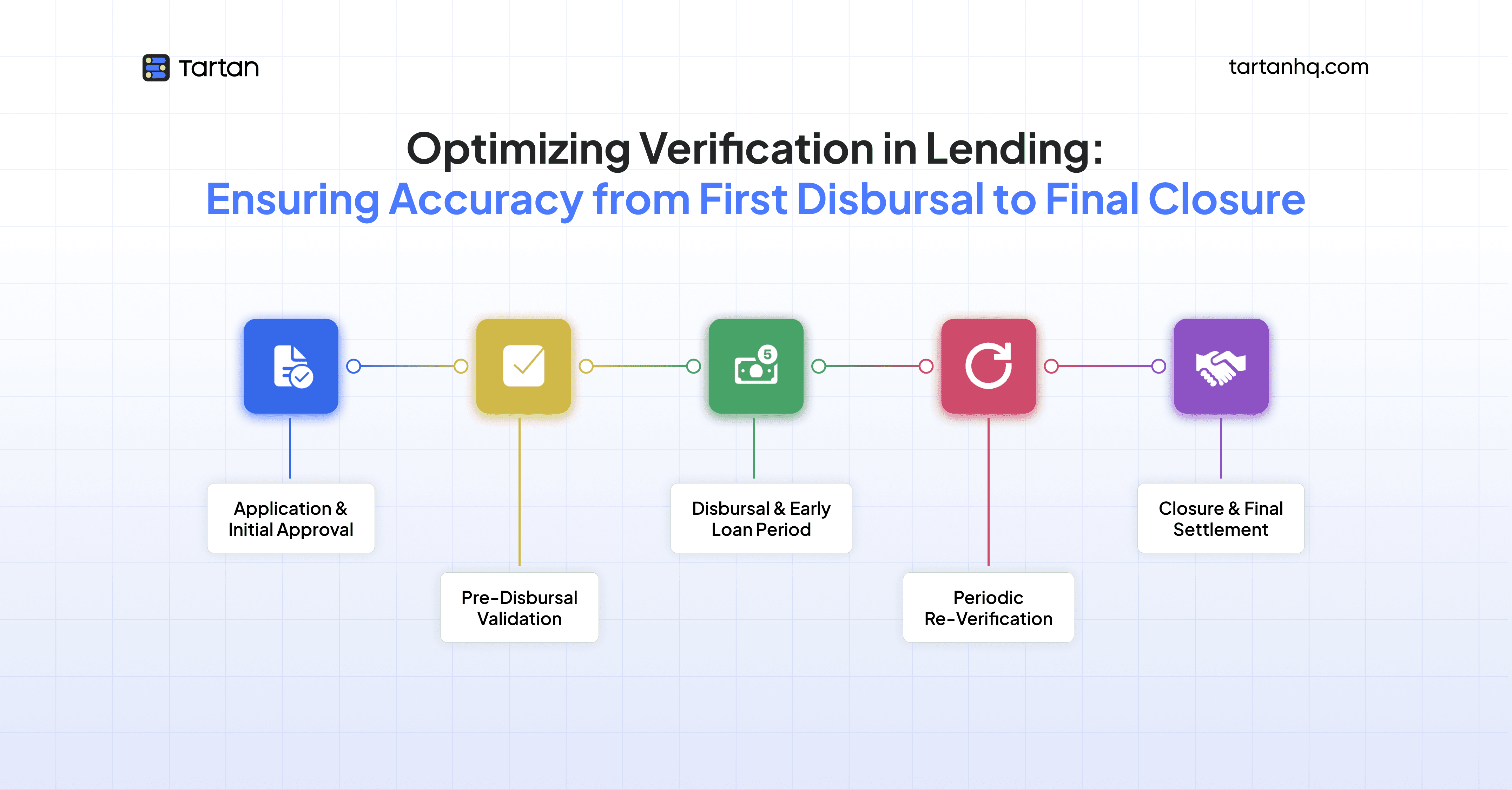

The need for verification doesn’t stop after the loan is disbursed. At every stage, from application to final closure, borrower information needs to be checked, ensuring that the loan remains aligned with both compliance standards and the institution's risk management strategies.

The Need for Re-Verification in the Loan Lifecycle

The loan lifecycle is not a static process. It is a series of stages where borrower circumstances can shift, often unpredictably, between the initial application and the final closure of the loan.

Relying only on initial verification, typically conducted at onboarding, leaves lenders exposed to potential risks as borrower’s situations evolve. A single verification at the beginning of the process does not account for changes that occur throughout the loan term, such as job changes, income fluctuations, or address discrepancies. This is why re-verification is critical at every stage of the loan lifecycle. In the absence of ongoing verification, lenders are left to make decisions based on outdated information, potentially leading to increased risk, compliance failures, or financial losses. Borrower data is dynamic and can change rapidly.

Here’s why re-verification is crucial:

Adaptation to Changes: Re-verification ensures lenders can adjust terms based on changes in borrower circumstances.

Financial Updates: Regular checks keep financial information current and accurate.

Contact Accuracy: Verifying contact details ensures efficient communication and payment processing.

Fraud Prevention: Ongoing verification detects and mitigates fraud risks.

Re-verification is not just about ensuring compliance, it’s a proactive step in mitigating risks and ensuring that loan terms remain relevant to both the borrower and lender. By regularly updating borrower data, lenders can:

Ensure loan terms match the borrower’s current situation.

Prevent issues from outdated or incorrect borrower data.

Protect the institution by meeting KYC, AML, and data protection regulations.

Ongoing re-verification builds trust and significantly improves the overall customer experience. Proactive verification ensures a smooth, transparent experience, minimizing issues during repayment or loan modifications, and reducing the risk of defaults and compliance breaches.

Stages of the Loan Lifecycle Where Re-Verification is Required

The loan lifecycle is not a linear, one-time process. It’s dynamic, with the borrower’s financial and personal situation often changing over time. This means that re-verification at different stages of the lifecycle is not just recommended, it’s necessary for maintaining data integrity, managing risk, and ensuring regulatory compliance.

Borrowers may undergo life events such as job changes, marital status updates, or relocation, all of which can impact their ability to repay loans. By embedding re-verification into the workflow at every key stage of the loan lifecycle, institutions can make more informed decisions, identify emerging risks early, and adjust loan terms accordingly.

This continuous process of verification helps lenders stay ahead of potential issues, reduce fraud, and ultimately ensure a smoother lending experience for both the borrower and the institution.

Loan Application and Initial Approval

At the start of the loan process, a borrower submits their application, providing personal information such as identity details, financial status, and employment history. This is the first point of validation in the loan lifecycle, where verification is typically performed through KYC (Know Your Customer) procedures to authenticate the applicant’s identity and establish their basic eligibility.

This initial check is crucial in determining whether the applicant qualifies for the loan, but it often only scratches the surface of a more comprehensive verification process. Here, re-verification may be required for:

Income & Employment Status: The borrower’s income or employment status might change between the time of application and disbursal, especially in volatile job markets.

Re-verifying income and employment ensures that the borrower is still capable of repaying the loan.

Fraud Prevention: Re-running checks to verify the authenticity of documents and flagged activity.

Pre-Disbursal Stage

After the loan is approved, it enters the pre-disbursal stage, where the financial institution finalizes the terms and prepares the funds for disbursal. Re-verification during this stage is crucial to confirming that the borrower still meets the agreed terms and that the loan amount is appropriate given their current situation.

Financial Stability: Ensures the borrower can still meet repayment terms despite changes in their financial situation.

Risk Mitigation: Reduces the risk of lending to borrowers with deteriorating financial health.

Compliance: Ensures ongoing adherence to regulatory standards throughout the loan lifecycle.

Key verification checks during the pre-disbursal stage include:

Address Verification: Re-checking the borrower’s address ensures it’s accurate and helps assess potential changes in risk, like relocation or financial strain.

Credit Bureau Cross-Check: Re-assessing the borrower’s credit score ensures there’s no decline in creditworthiness or new financial risks since the initial approval.

Re-verifying these key elements during the pre-disbursal stage is a proactive measure to ensure that both the borrower and the lender are still aligned with the terms set at the outset of the loan. It serves as a final checkpoint to mitigate risk and validate financial stability.

Loan Disbursal

Loan disbursal is when the lender releases the loan funds to the borrower. The disbursal phase is only one component, and the borrower’s ongoing eligibility must be continuously verified throughout the loan term especially for loans with extended repayment periods.

Verification at this stage is critical:

Retention of Compliance: Ensures documents like salary slips and tax returns remain valid and in compliance with KYC/AML regulations, avoiding legal issues.

Risk Mitigation: Identifies any changes in the borrower’s financial health and allows for necessary adjustments to prevent defaults and minimize risk.

By re-validating borrower data at this point, lenders ensure adherence to KYC and AML regulations, while also identifying potential shifts in financial circumstances that may affect the borrower’s ability to repay. This proactive approach allows lenders to adjust terms, manage risks, and mitigate the potential for defaults, ultimately protecting their portfolio and maintaining operational integrity throughout the loan lifecycle.

Periodic Re-Verification

As a loan progresses, periodic re-verification becomes essential to maintain an effective risk management strategy. Unlike the initial verification, which is typically a one-time event, periodic re-verification ensures that borrower information remains accurate and up-to-date throughout the loan lifecycle. This ongoing process helps lenders stay aware of any changes in the borrower’s financial circumstances, enabling timely adjustments to loan terms or repayment schedules when necessary.

Periodic re-verification is essential for:

Income Verification: Regular checks ensure the borrower’s income remains stable enough to meet repayment obligations, allowing lenders to act quickly if financial stress arises.

Employment Status: Periodic re-verification helps track job changes or layoffs, providing early warnings of potential repayment issues and enabling timely adjustments.

Fraud Detection: Continuous monitoring identifies emerging fraud risks, such as identity manipulation or falsified documents, protecting lenders from fraudulent activity.

Embedding periodic re-verification into the loan lifecycle ensures that lenders work with up-to-date and accurate borrower data, minimizing risk, improving operational efficiency, and protecting financial interests and compliance.

Loan Default or Delinquency Management

When a borrower defaults or becomes delinquent, swift action is required to assess the situation and determine the next steps. At this stage, re-verification of the borrower’s financial status is crucial to decide whether modified repayment terms are possible or if further collection efforts are needed.

Key verification steps include:

Assessing Financial Position: Identifying changes in the borrower’s financial status to guide appropriate action.

Re-verifying Collateral: Ensuring the value and availability of pledged assets for secured loans.

Validating Contact Information: Confirming up-to-date address and identity to facilitate effective recovery efforts.

Having accurate, up-to-date address and identity details ensures that collection efforts reach the borrower without delay. It enables effective communication, which is essential for negotiating repayment terms or pursuing further recovery actions.

Loan Closure and Final Settlement

As the loan reaches its final stages, it is crucial for lenders to verify that all repayment obligations have been fully met and the loan is officially settled. This ensures that no further action or liability remains on either side. Re-verification at this stage helps avoid any potential post-settlement issues, such as missed payments or discrepancies that could arise later.

Final Payment Confirmation: Ensure the borrower has made the final payment and cleared all balances, preventing future disputes or liabilities.

Closure Documents: Verify that all closure documents are properly submitted and filed, confirming the loan is officially closed and the borrower has met all obligations.

This final re-verification step is vital in closing the loan properly and guarantees that all parties involved are legally protected from future discrepancies.

Strategic Importance of Ongoing Re-Verification Throughout the Loan Lifecycle

Re-verification throughout the loan lifecycle is pre-conditioned for minimizing risks and ensuring data accuracy. As borrower circumstances shift whether through job changes, financial shifts, or address updates, regular checks ensure that the loan terms remain relevant and compliant with regulations. There are multiple factors as to why it is one of the crucial step during loan lifecycle:

Compliance: Ensures financial institutions stay aligned with evolving regulations, such as Data Protection and AML laws.

Risk Mitigation: Helps detect changes in borrower profiles, preventing fraud and identity theft.

Data Accuracy: Keeps borrower information current, reducing errors and improving operational efficiency.

Customer Experience: Streamlines the process, fostering trust by minimizing repetitive information requests.

Dynamic Risk Assessment: Enables lenders to adapt to changing borrower circumstances and adjust loan terms or recovery strategies.

Compliance and Regulatory Pressure: Periodic re-verification ensures compliance with evolving regulations like Data Protection and AML, safeguarding against legal risks.

Risk Mitigation and Fraud Prevention: Continuous checks detect changes in borrower profiles, preventing emerging risks such as fraud, money laundering, and identity theft.

Data Accuracy and Operational Efficiency: Lifecycle verification keeps records up-to-date, reducing errors and minimizing manual updates, improving operational efficiency.

Improved Customer Experience: Continuous verification offers a seamless process, reducing repeated information requests and fostering customer trust and loyalty.

Dynamic Risk Assessment: Ongoing verification allows for adaptive risk assessment, enabling lenders to adjust terms or recovery strategies based on changing borrower circumstances.

By embedding re-verification into each phase of the loan lifecycle, lenders can create a system that is not only more secure and compliant but also more responsive to changing borrower conditions.

It reduces the likelihood of defaults, ensures greater transparency, and enhances both operational efficiency and customer trust.

This approach ultimately strengthens the long-term stability of the lending institution. Continuous re-verification ensures greater transparency, helping both lenders and borrowers stay aligned on loan terms and expectations.

By streamlining the verification process, operational efficiency is greatly improved, minimizing the resources required for manual updates and mitigating costly errors.

Leveraging HyperVerify for Lifecycle-Based Verification

HyperVerify, an advanced API-driven solution, is designed to automate lifecycle-based verification, ensuring that financial institutions can maintain up-to-date, accurate borrower data without manual intervention.

With real-time data processing, AI-powered analysis, and machine learning, it integrates seamlessly with existing loan management systems, enhancing operational efficiency and risk management.

Automated Re-Verification: HyperVerify automates regular data checks, reducing manual efforts and ensuring up-to-date borrower data to minimize risks from outdated information.

Cross-System Data Synchronization: HyperVerify seamlessly integrates with data sources like HRMS and credit bureaus, ensuring accurate, consistent, and real-time borrower information across all platforms.

Fraud Detection: HyperVerify continuously monitors borrower data for potential fraud, such as synthetic identities or document inconsistencies, helping lenders address risks early.

HyperVerify’s comprehensive approach to lifecycle-based verification provides lending institutions with a scalable, efficient solution that ensures continuous compliance, reduces fraud risk, and enhances operational performance.

With automation and cross-system integration, it empowers financial institutions to stay ahead of regulatory requirements while improving the borrower experience, making it an essential tool for modern lending operations.

Furthermore, by embedding re-verification throughout the loan lifecycle, lending institutions can significantly enhance decision-making and operational agility. This approach directly impacts the ability to scale quickly and efficiently, while also enabling lenders to better manage their exposure to market fluctuations and borrower volatility.

Result? A responsive lending operation, with greater financial resilience, and the capacity to capitalize on new opportunities with confidence.

Tartan helps teams integrate, enrich, and validate critical customer data across workflows, not as a one-off step but as an infrastructure layer.