Insurance fraud directly impacts underwriting profitability, claims leakage, and loss ratios.

It is a direct balance-sheet risk with measurable loss impact, a regulatory exposure with audit and penalty implications, and a trust problem that compounds over the customer lifecycle.

Fraud losses affect underwriting margins and combined ratios; weak controls increase supervisory scrutiny; inconsistent decisions erode confidence among distributors, partners, and policyholders.

These impacts are measurable and cumulative. Fraud-related losses do not arise at a single point in the journey; they are introduced incrementally across proposal intake, policy issuance, endorsements, and claims settlement when controls fail to discriminate risk accurately.

Friction in onboarding affects proposal conversion.

Delays in claims processing affect renewal intent.

Repeated verification requests increase call-center dependency and operational cost.

For insurance enterprises operating at scale, experience is now tightly coupled with unit economics, not just brand perception. Yet, most insurance enterprises continue to treat fraud prevention and customer experience as competing priorities rather than outcomes of the same control framework.

When fraud indicators rise or regulatory scrutiny increases, controls are expanded uniformly across workflows - additional verification steps, broader document requirements, and higher volumes of manual review. When conversion rates drop or claims backlogs grow, the response is often the opposite - controls are relaxed, exceptions are widened, or risk thresholds are softened. This reactive approach creates repeated policy reversals, weakening risk discipline and executive confidence in control effectiveness. Non-selective fraud controls add friction without materially improving risk outcomes.

For leadership, the problem is not choosing between stricter fraud control and better customer experience. The problem is operating without precision. Without risk-based application of verification and fraud checks, insurance workflows increase customer and operational friction while failing to intercept high-impact fraud.

The Structural Mismatch: Uniform Controls Applied to Asymmetric Risk

Insurance fraud is inherently asymmetric.

It is highly concentrated in a small subset of cases, while the majority of policies represent low, predictable risk with defined service expectations.

Even so, operational controls are applied uniformly across the portfolio, creating a structural mismatch between risk concentration and control deployment. This disconnect reflects a foundational control design issue rather than an execution gap.

Despite this asymmetry, many insurance workflows apply identical verification and fraud checks across the entire book. Proposal journeys, endorsements, and claims are subjected to the same documentation requirements, validation steps, and review thresholds regardless of risk contribution. Controls are triggered by workflow stage rather than exposure, behavior, or anomaly.

As volume scales, this approach increases processing load without improving loss containment.

Uniform application of fraud and verification controls creates second-order effects that are often invisible at a workflow level but material at an enterprise scale. When control design does not distinguish between low-risk volume and high-risk exposure, it degrades both investigative effectiveness and operating efficiency.

Operational impact on fraud and investigation teams:

Low-risk cases consume fraud team capacity: Routine transactions follow the same review paths as suspicious ones, limiting focus on material risk.

Risk signals lose effectiveness: When every case triggers similar checks, it becomes harder to identify genuine anomalies.

Queues increase without better detection: High-risk cases are delayed alongside standard volume, extending resolution time without improving outcomes.

Scrutiny becomes uneven: Review depth is driven by queue pressure rather than actual risk severity.

For the business, this structure creates compounding costs. Legitimate customers absorb friction through delays, repeated information requests, and assisted processing. Operations teams absorb higher cost per policy and per claim. Risk teams absorb residual exposure because controls are broad but shallow. The system appears controlled, but discrimination is weak.

When fraud and verification frameworks fail to reflect asymmetric risk distribution, insurers incur ongoing customer friction and fraud leakage with no corresponding gain in control effectiveness.

Why Fraud Controls and Experience Outcomes Are Structurally Linked in Insurance Workflows

In insurance, fraud detection is embedded directly into core operational decision points. These checks are not peripheral controls that run in the background; they sit on the critical path of revenue recognition, risk assumption, and claims payout. As a result, every fraud control decision has an immediate operational and commercial consequence.

Key workflow checkpoints where fraud controls intersect with business outcomes include:

Proposal submission: Determines conversion, straight-through processing, and distribution efficiency

Policy issuance: Impacts time-to-cover, compliance posture, and customer activation

Endorsements and renewals: Affects persistency, servicing cost, and revenue continuity

Claims intimation: Influences early fraud detection, claims triage, and customer escalation

Claims settlement: Directly impacts loss ratios, dispute rates, and regulatory exposure

At each of these stages, fraud checks directly influence approval speed, operational cost, and customer attrition. Unlike post-decision risk reviews, these controls operate in-line with transaction execution. Any delay, rework, or escalation immediately affects throughput and cost.

The direct linkage between fraud controls and operational outcomes is what structurally differentiates insurance from other financial services.

In lending, friction can often be absorbed upfront and amortized over a long customer relationship. In insurance, many interactions particularly claims occur at discrete, high-impact moments. Controls introduced at these points cannot be treated as neutral from an experience or cost perspective.

From an enterprise standpoint, this creates a constraint: fraud controls cannot be optimized independently of workflow performance.

Operational Implications Across the Insurance Lifecycle

As fraud checks sit directly on the transaction path, their design has cascading effects across teams, systems, and performance metrics. Any additional check, delay, or escalation immediately impacts throughput, handoff volume, and cost per transaction.

At onboarding and policy issuance

Additional verification steps increase proposal drop-offs and assisted processing

Manual reviews extend issuance timelines and increase distribution dependency

Uniform controls reduce straight-through processing rates without improving risk selection

At servicing and renewals

Re-verification increases handling cost for low-risk accounts

Inconsistent controls create exceptions that require human intervention

Poorly sequenced checks increase renewal friction and lapse risk

At claims

Blanket checks delay settlement for routine claims

Low-risk claims consume investigation capacity

Escalations increase dispute rates and customer complaints

These impacts are not theoretical. They show up as higher cost per policy, higher cost per claim, lower conversion, and lower renewal efficiency.

The Core Failure: Verification Designed as a Static, Front-Loaded Event

Most insurance verification architectures are built on a single operating assumption:

if risk is validated comprehensively at the point of entry, that decision can be reused across the lifecycle.

This assumption shapes how verification systems are implemented in practice:

Identity, address, and document validation are concentrated at proposal or policy issuance, regardless of risk profile or product exposure.

The same verification results are relied upon for underwriting, endorsements, claims processing, and audits, often months or years later.

Re-verification is triggered only by explicit failure conditions, exceptions, or disputes, rather than continuous risk signals.

Concentrating verification intensity at entry points also front-loads friction before value is delivered. Low-risk and high-risk customers are subjected to the same checks, even when exposure is limited or predictable.

This uniform application produces consistent enterprise outcomes: lower proposal completion due to early friction, higher assisted journey volumes that increase distribution and operations cost, delayed time-to-cover affecting activation, and no corresponding improvement in downstream fraud outcomes.

The result is a structural imbalance in control design. Verification effort is concentrated upfront, while risk continues to change across the policy lifecycle without corresponding reassessment.

This is not a gap in verification rigor or intent, but a placement problem controls are applied early, uniformly, and statically in an environment where risk is dynamic and unevenly distributed. Until verification frameworks move from front-loaded validation to lifecycle-aware, risk-responsive control, insurers will continue to absorb conversion loss while carrying residual fraud exposure.

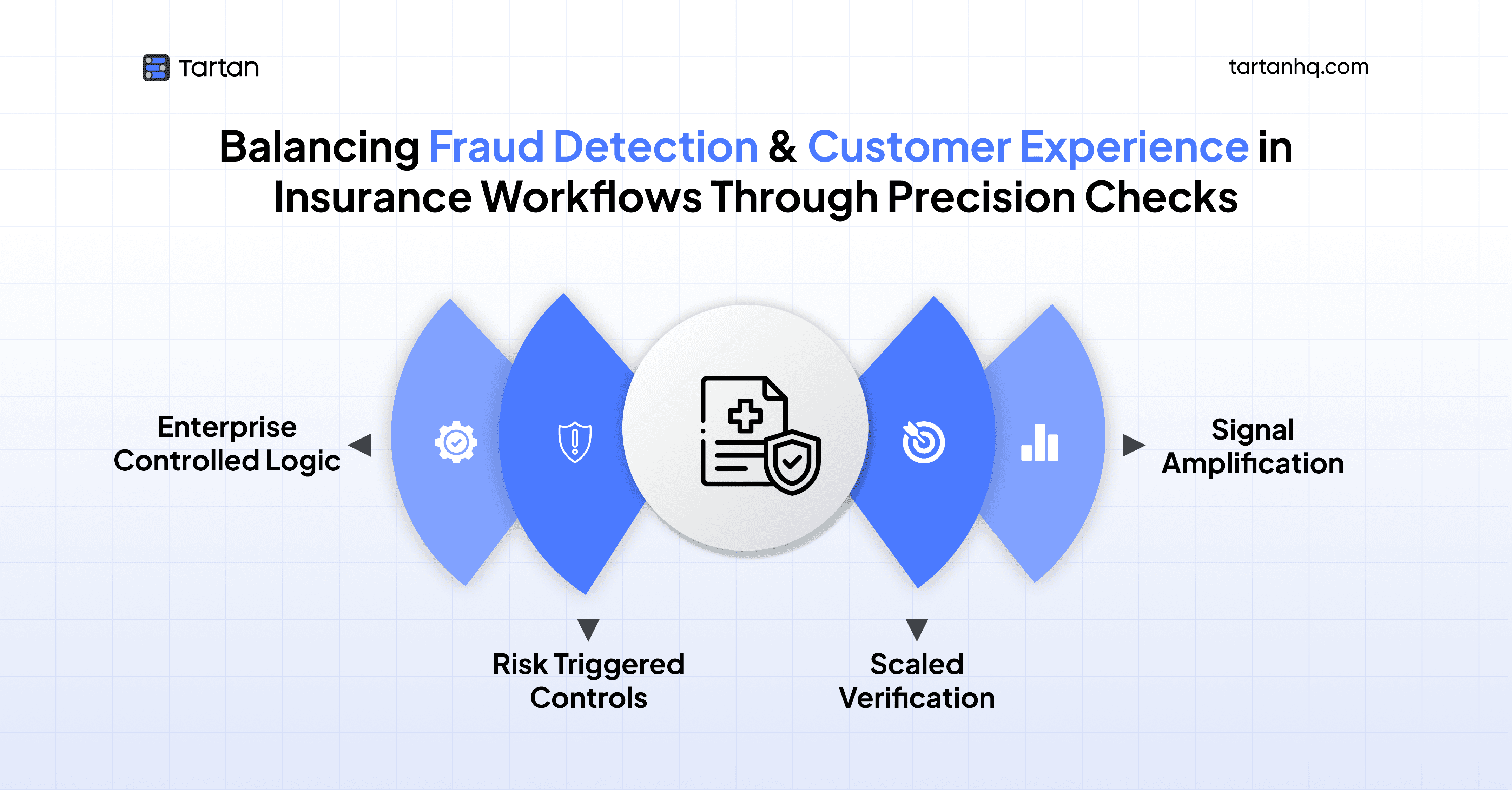

Precision Checks: The Missing Layer in Insurance Workflows

Precision checks are not about increasing the number of controls or introducing additional verification layers. They are about deploying control intensity selectively based on exposure, behavior, and signal quality rather than applying uniform friction across all transactions.

The objective is to reduce unnecessary checks on low-risk volume while increasing scrutiny where loss exposure is material.

In most insurance workflows today, verification logic is tied to process stages instead of risk contribution. Checks trigger because a proposal is submitted, a claim is raised, or an endorsement is requested not because the underlying risk profile warrants deeper scrutiny. Precision checks reverse this logic.

They activate controls based on what changes risk, not where the customer is in the workflow. A precision-led approach reframes verification as a dynamic control system with three defining characteristics.

First, controls are risk-triggered rather than step-triggered. Verification depth increases only when risk signals justify escalation. Clean, low-risk cases move through workflows with minimal interruption, while anomalous patterns - mismatches, behavioral deviations, signal conflicts activate additional scrutiny. This ensures that investigative effort is concentrated where loss potential is highest, rather than spread evenly across volume.

Second, controls are progressive rather than front-loaded. Verification intensity scales with exposure over time. Early-stage interactions are clear with lightweight checks, while higher-value or higher-risk actions - policy upgrades, high-value claims, repeated servicing requests justify deeper validation. This reduces upfront friction without compromising downstream risk containment.

Third, controls are explainable and internally governed. Precision checks are designed to produce clear, auditable decision rationale. Each escalation is tied to specific signals and thresholds defined by the enterprise, not opaque vendor outputs. This improves regulatory defensibility, reduces reliance on manual justification, and gives leadership visibility into why decisions were made.

From an operating perspective, precision checks shift verification from a compliance exercise to a risk allocation mechanism. Instead of spending cost, enterprises allocate control effort proportionally minimizing friction for predictable volume while preserving scrutiny for material risk.

Without this layer, insurers face a binary choice: absorb operational friction or carry residual fraud exposure. With it, fraud control and workflow efficiency are governed through the same control framework.

Claims: Where Blanket Fraud Controls Create the Highest Cost and Risk Exposure

Claims workflows expose the weakest points in insurance control design. Unlike onboarding or underwriting, claims operate at the moment of financial outflow and customer expectation. Every control applied here directly affects settlement timelines, loss ratios, dispute rates, and regulatory posture.

As a result, any inefficiency or misapplied friction in claims has an immediate and compounding business impact.

In insurance organizations, claims fraud controls are applied uniformly, regardless of claim value, customer history, or behavioral risk. This creates predictable operational patterns:

Repeated verification: Customers are asked to resubmit information already verified earlier.

Manual review of low-risk claims: Routine claims follow the same review path as higher-risk cases.

Delays from internal handoffs: Claims slow down due to movement across teams, not risk signals.

These patterns produce two systemic failures that scale with volume.

First, customer trust degrades at the moment of highest sensitivity. Claims represent the point at which policy value is realized. Delays, repeated requests, and unclear status updates increase complaint rates, escalation to regulators, and dispute costs. Even when claims are eventually paid, the experience negatively impacts renewal intent and lifetime value.

Second, fraud and investigation teams lose effectiveness. When low-risk claims dominate review queues, investigators spend time clearing volume instead of isolating material fraud. Signal quality deteriorates, prioritization becomes workload-driven, and genuinely suspicious cases face delays alongside routine claims. The organization appears controlled, but actual fraud discrimination weakens.

At an enterprise level, blanket friction in claims increases cost per claim, weakens fraud outcomes, and damages customer trust simultaneously. Precision-based claims controls convert fraud detection from a volume-processing problem into a risk-allocation discipline improving loss containment without degrading settlement efficiency.

Moving From Vendor Logic to Enterprise Control

Insurance enterprises cannot delegate decision ownership. While execution may be handled by vendors, platforms, or service providers, accountability for risk outcomes remains internal.

Fraud and verification decisions in insurance are often governed by a vendor-driven decisioning model. External platforms define thresholds, escalation criteria, and failure conditions, while internal teams primarily operationalize these outputs. This approach accelerates initial deployment but constrains enterprise control as volumes increase, risk patterns diversify, and regulatory expectations intensify.

Vendor-led decisioning reduces enterprise control in three critical ways.

Decisions lack transparency: When outcomes rely on vendor scores or flags, teams cannot clearly explain approvals, delays, or rejections during audits or reviews.

Controls are hard to adapt: Vendor-defined logic is standardized, making it difficult to tailor checks by product, channel, geography, or claim value.

Accountability is unclear: When decisions are challenged, ownership shifts between teams and vendors, slowing resolution and increasing compliance risk.

Precision-led verification frameworks address this by re-centering decision control within the enterprise. They allow insurers to define how signals are interpreted, when checks escalate, and where control intensity should increase.

This allows insurers to retain ownership of risk logic by defining enterprise-specific thresholds, escalation triggers, and acceptance criteria aligned to portfolio strategy, regulatory posture, and loss tolerance.

For leadership teams, misalignment in fraud controls is not indicated by fraud trends or experience metrics in isolation. It becomes evident when the organization cannot clearly explain why specific controls exist, what risk they mitigate, and where they create measurable value in the workflow.

When these questions do not have clear, evidence-backed answers, friction is often compensating for weak risk discrimination. This results in higher operating cost, slower throughput, and ongoing risk exposure without a corresponding increase in control effectiveness. The focus should not be on reducing the number of controls, but on ensuring that each control is deliberate, aligned to material risk, and governed within the enterprise rather than deferred to external logic.

The Strategic Shift: From More Checks to Smarter Control

Balancing fraud detection and customer experience is a function of control maturity, not a trade-off between risk and growth.

Early-stage insurance operations often rely on blanket checks because they are easy to implement and simple to justify. As scale increases, this approach becomes structurally inefficient. Uniform controls increase volume, cost, and friction, but do not improve risk discrimination. The organization appears more controlled, yet outcomes deteriorate across both loss containment and workflow efficiency.

Enterprises that continue to rely on blanket friction encounter predictable second-order effects:

Rising operational costs: Manual reviews increase, straight-through processing rates decline, and cost per policy or claim escalates as low-risk volume absorbs unnecessary control effort.

Declining conversion and renewal efficiency: Excess friction during onboarding, servicing, and claims directly impacts proposal completion, settlement timelines, and persistence.

Regulatory pressure without defensibility: When controls are broad but poorly differentiated, explaining specific decisions to regulators or auditors becomes difficult, increasing compliance risk.

Enterprises that invest in precision checks adopt a fundamentally different operating model. Control effort is no longer distributed uniformly across volume, but allocated proportionally to risk contribution. Low-risk transactions clear with minimal intervention, while control depth increases only where exposure, anomaly, or behavioral signals justify it.

This shift improves risk discrimination, reduces unnecessary operational load, and allows fraud and verification teams to focus capacity on cases that materially impact loss and compliance outcomes.

The next phase of insurance verification will be defined by how precisely control effort is allocated, not by faster processing or universally stricter rules. Enterprises that adopt risk-aligned, selective controls move from reactive fraud handling to scalable, governed control maturity.

Tartan helps teams integrate, enrich, and validate critical customer data across workflows, not as a one-off step but as an infrastructure layer.