Most enterprises don't start with five verification vendors.

They start with one.

A KYC provider for identity verification. It works well. Compliance is happy. Then business needs evolve. You need income verification for lending products - your KYC vendor doesn't offer that. You add a second vendor. Then you expand to new geographies requiring local address verification. That's vendor three. Your fraud team insists on specialized fraud signals. Vendor four. Document parsing for loan applications needs better OCR accuracy than your current stack provides. Vendor five.

Each solves a narrow problem. Each promises "best in class" capabilities. Each vendor relationship feels justified in isolation.

Together, they create operational drag that compounds silently across your organization until verification becomes a bottleneck rather than an enabler.

How Vendor Proliferation Happens

The path to five verification vendors is tactical, not strategic:

Year 1: Launch with a KYC provider for identity verification. Digital onboarding works. Compliance is satisfied.

Year 2: Lending products need income verification. Your KYC vendor doesn't offer it. You add a specialized income verification vendor. Three months of integration.

Year 3: Geographic expansion requires local address verification. You add a regional provider with local data sources. Another integration project.

Year 4: Fraud losses spike. Your KYC vendor's fraud capabilities are basic. You implement dedicated fraud prevention with device fingerprinting and behavioral signals.

Year 5: Document processing accuracy limits conversion. You add a specialized vendor with advanced OCR.

Five vendors. Each serves a legitimate need. Each integration was justified by ROI. But nobody planned for the fragmentation.

The Hidden Costs of Fragmentation

Engineering Overhead

Each vendor requires three to six months of initial integration, ongoing API maintenance when vendors deprecate endpoints, and custom orchestration logic to coordinate multiple vendors. With five vendors releasing quarterly updates, teams perpetually maintain integrations.

Vendor Management Burden

Five contracts to negotiate and renew. Five SLA agreements to monitor. Five security assessments and compliance reviews. Vendor risk management compounds rather than scales linearly.

Operational Complexity

Multiple dashboards for different teams. Month-end reconciliation requires pulling reports from five vendors and normalizing formats. Customer verification failures require multi-vendor debugging - which vendor caused the issue?

Degraded Reliability

When verification fails, accountability blurs. Was it the KYC provider? Address vendor? Document parser? Fraud API? Five vendors at 99.5% uptime each yield 97.5% system reliability - nearly 20 hours down monthly.

The Innovation Penalty

Vendor fragmentation slows innovation velocity:

Product Launches Become Coordination: New products require coordinating across all vendors. Does your KYC vendor support the needed flows? Can your income vendor provide the right data format? Product launches are gated by vendor capabilities.

Geographic Expansion Means Re-Integration: Entering new markets requires evaluating vendor coverage. Often, you must add another vendor with local support or delay expansion. Growth becomes hostage to vendor roadmaps.

Policy Changes Require Multi-Vendor Updates: Regulatory changes ripple across five vendors. Simple policy updates become complex coordination exercises across identity, income, fraud, and document processing vendors.

Why Risk Teams Lose Confidence

Incomplete Signal Correlation: Fraud emerges from patterns across data points. When identity, income, address, and behavioral signals live in separate systems, correlation requires manual work. Is claimed address consistent with device location? Does employment tenure align with income? These cross-signal correlations are powerful but difficult when data is siloed.

Audit Trail Complexity: Regulatory audits require comprehensive documentation. With five vendors, assembling why a customer was approved requires pulling data from five systems and reconstructing decision logic.

Inconsistent Data Quality: Each vendor has different data standards, freshness, and coverage. These inconsistencies create risk exposure that's hard to quantify.

HyperVerify: The Unified Verification Layer

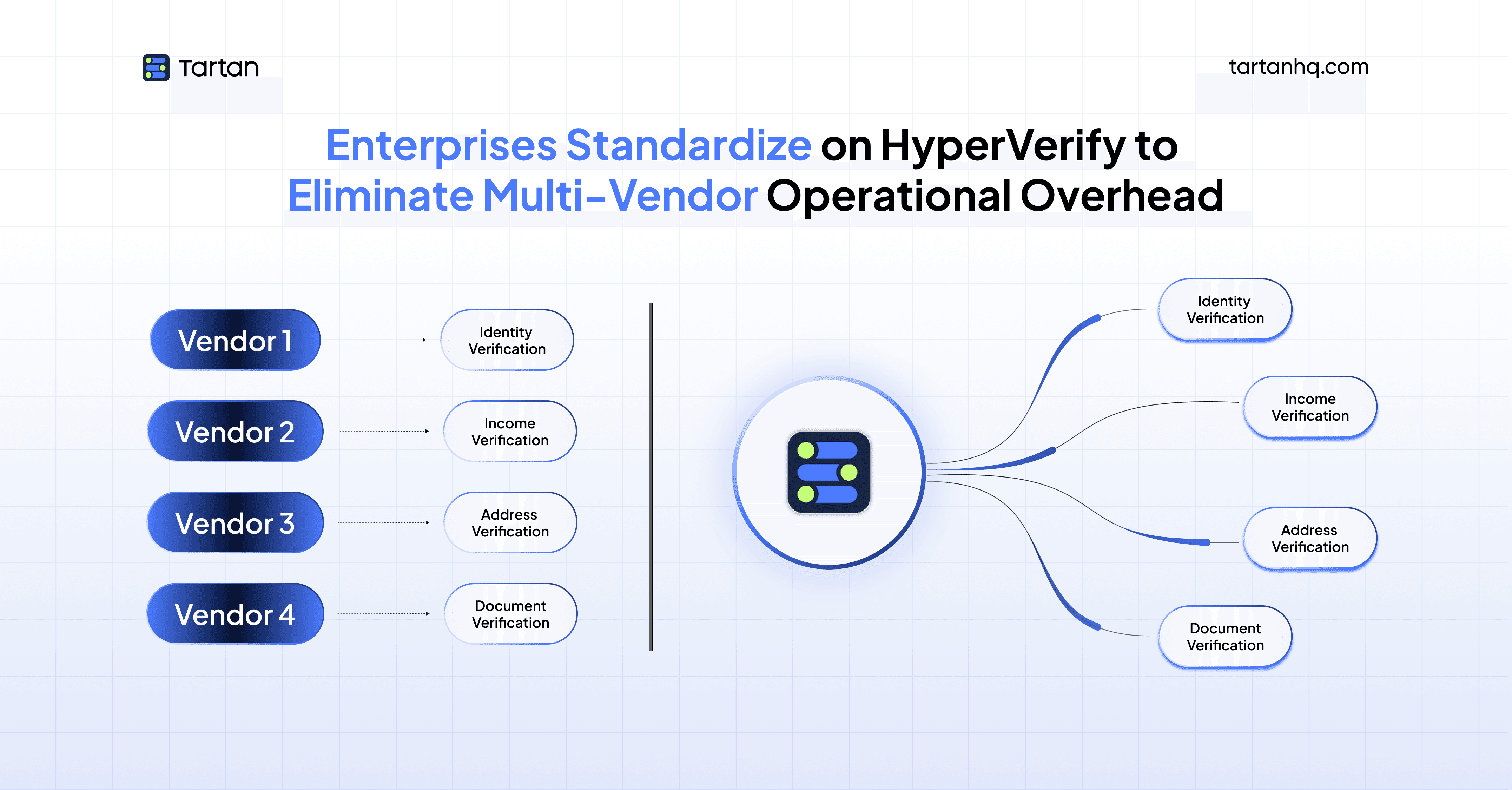

HyperVerify addresses fragmentation by providing a unified verification platform covering identity, income, address, documents, fraud, and device intelligence in a single system.

One Integration, Complete Coverage

Instead of integrating with five vendors, enterprises integrate once with HyperVerify's API. All verification capabilities - KYC, income verification, address validation, document processing, fraud detection, device intelligence - are accessible through standardized endpoints.

New verification types don't require new integrations. When your product needs employment verification that wasn't part of the initial implementation, it's available through the same API. Zero additional integration work.

When you expand geographically, HyperVerify's coverage extends across regions without requiring new vendor relationships or integration projects.

Correlated Signals, Better Decisions

Because all verification data flows through a single platform, HyperVerify correlates signals across verification types:

Cross-Verification Consistency Checks: Is the address on the uploaded ID document consistent with the address provided in the application? Does the employment tenure claimed match the income history? Are there fraud signals associated with the device used for document upload?

These correlations happen automatically within HyperVerify's decision engine - not as custom logic you must build and maintain.

Unified Risk Scoring: Rather than aggregating risk scores from five vendors (each with different scales and methodologies), HyperVerify provides a single, calibrated risk score based on all available signals. Risk teams can trust the score's meaning and build policies around it consistently.

Orchestrated Workflows, Not Patched Logic

Verification workflows in HyperVerify are orchestrated through configuration, not custom code:

Conditional Logic: Configure when to request certain verifications. If identity confidence is high, skip document upload. If fraud signals are elevated, require additional verification steps. These rules are configured in HyperVerify's workflow engine.

Parallel Processing: When multiple verifications can run concurrently - identity and address checks - HyperVerify executes them in parallel automatically.

Fallback Strategies: If a primary data source is unavailable, HyperVerify automatically attempts fallback sources. No vendor-specific retry logic in your code.

One Control Plane for Operations

All verification activity is visible in a unified dashboard:

Single Source of Truth: Fraud analysts, compliance teams, and operations work from the same interface. Verification outcomes, risk signals, and decision logic are consistent across teams.

Streamlined Reconciliation: One vendor report. One invoice. Finance teams save hours monthly on verification cost reconciliation.

Unified Support: One support relationship. HyperVerify owns end-to-end troubleshooting - whether the issue is in identity verification, document processing, or fraud detection.

The Business Impact

Reduced Engineering Overhead: 60-70% reduction in verification-related engineering time. Freed capacity goes toward product features rather than verification plumbing.

Faster Product Launches: New products that required 3-6 months of vendor coordination now complete in weeks. All verification capabilities are available through HyperVerify.

Improved Reliability: Single SLA instead of compound probability across five vendors. Fewer failure points. Faster resolution with clear accountability.

Better Risk Outcomes: Correlated signals catch fraud patterns siloed vendors miss. Risk models perform better on complete data. Audit preparation is straightforward.

Lower Total Cost: While HyperVerify's platform fee may exceed any single vendor's cost, total ownership decreases 30-40% when accounting for engineering overhead, vendor management, compliance reviews, and reconciliation.

Conclusion

Vendor fragmentation in verification isn't a strategy - it's the unintended consequence of solving point problems without considering system-level architecture.

Each verification vendor adds contracts, integrations, dashboards, and failure points. What looks like best-of-breed diversification creates operational drag that compounds across engineering, compliance, operations, and risk functions.

The pattern is predictable: start with one vendor, add another for a specific need, then another for geographic coverage, another for fraud capabilities, another for document processing. Each decision makes sense in isolation. Together, they create complexity that degrades system reliability, slows innovation, and increases total cost of ownership.

HyperVerify provides an alternative: a unified verification layer covering identity, income, address, documents, fraud, and device intelligence in one platform. One integration. One contract. One control plane.

Signals are correlated, not siloed. Workflows are orchestrated through configuration, not patched together with custom code. Decisions are automated within a unified risk engine, not manually aggregated across disparate vendor scores.

The result is lower operational overhead, more predictable risk outcomes, and faster product velocity. Verification transforms from a bottleneck into infrastructure that enables growth rather than constraining it.

For enterprises managing multiple verification vendors, the question isn't whether to consolidate - it's how quickly you can execute the migration before complexity costs exceed the benefits of fragmentation.

Because at scale, verification fragmentation isn't just inefficient. It's a competitive disadvantage against organizations that treat verification as unified infrastructure rather than a collection of point solutions that must be manually orchestrated.

The enterprises winning in financial services, fintech, and digital commerce aren't necessarily the ones with the most verification vendors. They're the ones with verification architecture that enables innovation velocity instead of creating coordination overhead.

HyperVerify provides that architecture. So teams spend less time managing vendor relationships and more time shipping products that drive outcomes.

Tartan helps teams integrate, enrich, and validate critical customer data across workflows, not as a one-off step but as an infrastructure layer.