GST verification has become the de facto standard for business identity checks in India. It's quick, it's government-backed, and it feels authoritative. For most companies onboarding business clients, a valid GSTIN seems like proof enough that they're dealing with a legitimate entity.

But here's the uncomfortable truth: fraudsters know this too. And they've adapted.

If your KYB process stops at GST verification, you're leaving your business exposed to a growing category of sophisticated fraud that exploits the very assumptions most decision-makers make about government registrations.

The GST Verification Trap

GST verification confirms one thing with certainty: that a GST number exists in the government database and matches the business name provided. That's valuable information, but it's also where many compliance teams stop asking questions.

The problem isn't with GST verification itself. The problem is treating it as conclusive evidence of legitimacy when it's actually just the starting point. A valid GSTIN tells you that someone, at some point, registered for GST. It doesn't tell you:

Whether the business is actually operational

If the registered address corresponds to a real place of business

Whether the ownership details are accurate

If the entity has any history of financial activity

Whether the company exists for legitimate commercial purposes

Fraudsters understand this gap intimately. They've built entire operations around obtaining valid GSTINs for entities that exist only on paper.

How Fraudulent Businesses Get Valid GSTINs

The routes to obtaining a seemingly legitimate GST registration are more accessible than most people realize.

Shell companies with minimal documentation. In certain jurisdictions, it's possible to register a company and obtain a GSTIN with relatively light documentation requirements. These entities maintain just enough paperwork to appear legitimate while conducting no real business operations.

Identity theft and document fraud. Criminals use stolen or fabricated identity documents to register businesses under other people's names. The victims often don't discover the fraud until much later, sometimes only when authorities come knocking about unpaid taxes or financial irregularities.

Dormant company takeovers. Fraudsters identify legitimately registered but inactive companies and either take them over through fraudulent means or impersonate them. These companies have valid registrations, established histories, and in your system, they look completely authentic.

Synthetic business identities. This emerging threat involves creating entirely fictional business entities using a combination of real and fabricated information. These businesses pass basic verification checks because parts of their identity are genuine, even though the entity itself serves no legitimate purpose.

The sophistication here is noteworthy. We're not talking about obvious red flags like mismatched names or clearly invalid numbers. These are businesses that pass GST verification cleanly because, technically, they're registered. The fraud lies in what happens after registration.

What GST Verification Misses

Consider what actually happens when you verify a GSTIN. You send a request to the government database, and you get back confirmation that the number is valid, along with basic details like the business name, registration date, and registered address.

What you don't get is context. You don't learn that the registered address is a virtual office space shared by 200 other businesses. You won't discover that the entity has never filed a single return despite being registered for two years. The system won't flag that the business was registered using documents that have since been reported as stolen.

GST verification is a snapshot of registration status. It's not a verification of commercial legitimacy, financial stability, or operational reality. For decisions involving credit, partnerships, or significant financial exposure, that distinction matters enormously.

The Real-World Impact

The consequences of relying solely on GST verification play out across industries in predictable patterns.

Lending platforms discover too late that the business they disbursed funds to has no actual operations, no employees, and an address that leads to an empty lot. The GSTIN was valid. The fraud was real.

B2B marketplaces onboard sellers who accept advance payments for inventory they'll never deliver. Their GST verification passed. Their victims multiplied.

Invoice financing companies advance funds against invoices from non-existent transactions between shell companies. Every entity involved had a valid GSTIN. The entire commercial relationship was fabricated.

These aren't hypothetical scenarios. They represent millions in losses across the fintech and B2B sectors, and in nearly every case, GST verification was completed successfully. The verification wasn't wrong; it just wasn't enough.

Building a Layered Verification Approach

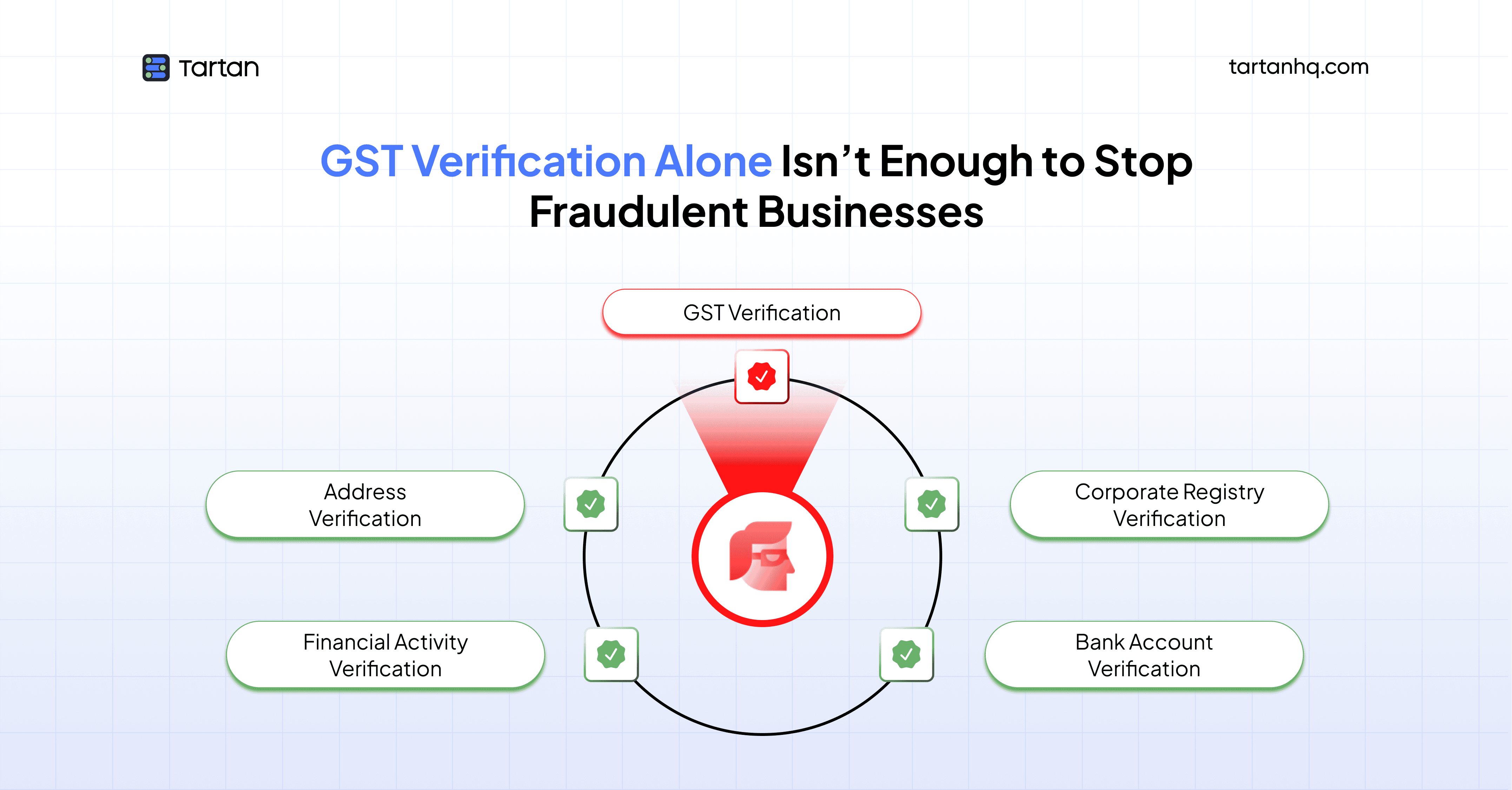

Effective KYB verification requires multiple data points that corroborate each other and paint a complete picture of business legitimacy. GST verification should be your first check, not your last.

Corporate registry verification confirms that the business exists as a legal entity beyond its tax registration. This catches synthetic identities and impersonation attempts where fraudsters have obtained a GSTIN but haven't actually incorporated the business they claim to represent.

Bank account verification establishes that the business has an active financial relationship with a regulated institution. Banks conduct their own due diligence during account opening, and an active bank account signals that the business has cleared at least one additional layer of verification. More importantly, it confirms that the entity can receive and send payments, a basic requirement for commercial legitimacy.

Address verification goes beyond checking the registered address on paper. Physical verification or digital confirmation that a business operates from its stated location catches virtual office fraud, address manipulation, and cases where businesses exist only as registry entries.

Directorial and ownership checks reveal who actually controls the business and whether those individuals have clean records. A pattern of directors involved in multiple failed or fraudulent entities is a red flag that GST verification alone will never surface.

Financial activity verification confirms that the business engages in actual commercial operations. This might involve checking trade licenses, professional registrations, or evidence of business transactions. A company registered for three years with zero commercial activity isn't necessarily fraudulent, but it's certainly unusual.

The power of this approach isn't in any single verification. It's in the pattern that emerges when you cross-reference multiple data points. Legitimate businesses pass all these checks naturally because they're actually operating.

Fraudulent entities struggle to maintain consistency across multiple verification layers because fabricating entire business ecosystems is exponentially harder than obtaining a single registration.

Making Verification Scalable

The obvious concern with comprehensive KYB is operational burden. If verifying GST takes seconds and you need to add five more checks, how do you avoid turning onboarding into a multi-day nightmare?

This is where intelligent automation becomes essential. Modern verification platforms can run multiple checks simultaneously and return results in near real-time. The technology exists to verify corporate registrations, check bank accounts, confirm addresses, and screen ownership without manual intervention.

The key is building verification workflows that adapt to risk levels. Low-risk businesses might pass through with automated checks. Medium-risk cases could trigger additional verification requirements.

High-risk applications get flagged for manual review. This tiered approach maintains speed for legitimate businesses while adding friction exactly where you need it.

Decision-makers should think about verification infrastructure the same way they think about payment processing or cloud hosting: as critical infrastructure that requires investment and expertise but ultimately becomes a competitive advantage. The platforms that can onboard businesses quickly and safely will win their markets.

The Regulatory Wind is Shifting

Regulators are increasingly aware that basic verification isn't sufficient for managing systemic risk. RBI guidelines for fintechs already emphasize comprehensive due diligence, and enforcement is tightening. When fraud occurs, "we verified their GST" is unlikely to satisfy investigators or protect against regulatory consequences.

Beyond compliance, there's reputational risk. Every fraudulent business that slips through your KYB process becomes a liability. They might default on credit, commit fraud against other users, or attract regulatory scrutiny that extends to your platform. The cost of comprehensive verification is trivial compared to the cost of cleaning up after preventable fraud.

Moving Forward

GST verification has its place. It's a useful signal, a necessary first step, and an efficient way to confirm basic registration details. But it was never designed to be a comprehensive fraud prevention tool, and treating it as one creates vulnerability.

The businesses winning in this environment are those building verification systems that assume sophistication from fraudsters rather than hoping for obvious red flags. They're investing in technology that cross-references multiple data sources, flags inconsistencies, and builds confidence through corroboration rather than single-point verification.

For decision-makers, the question isn't whether to verify beyond GST. The question is how quickly you can implement comprehensive KYB before the next fraudulent business walks through your verification process with a perfectly valid GSTIN and nothing else to back it up.

The fraudsters already know GST verification isn't enough. Make sure your verification system knows it too.

Tartan helps teams integrate, enrich, and validate critical customer data across workflows, not as a one-off step but as an infrastructure layer.